PETALING JAYA: When V. Nandini landed her first job as a copywriter about a decade ago, she was over the moon.

Her first drawn salary of RM2,400 in 2015 had helped her live quite comfortably.

“Back then, a full meal at roadside stalls cost less than RM10. And after deducting grocery, rental and other expenses, I would still have some balance left for savings,” she said.

Nandini, who is now 34 and earns substantially more, said that despite the better wages, the cost of living is a challenge.

ALSO READ: More relief and a new tax this year

“Even though I have more cash in hand, it doesn’t feel as comfortable as it used to be,” she said.

“A month of groceries used to cost only about RM150 but now I’m paying double for the exact same items.

“I have to budget more carefully now.”

Furthermore, she is caring for her parents.

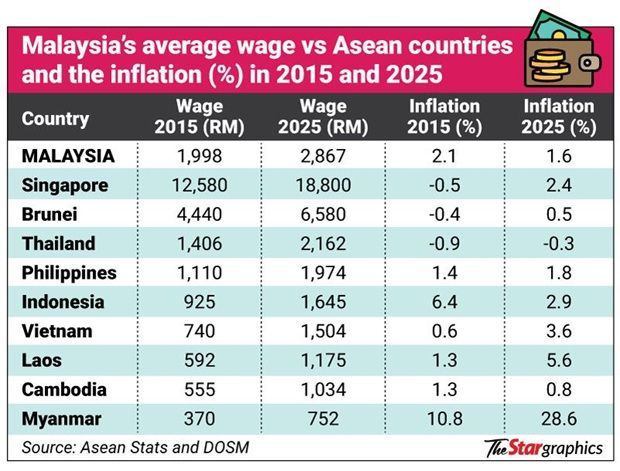

ALSO READ: Inflation erodes real income gains despite wage hikes

Nandini’s situation is a typical case faced by many people.

A decade after earning their first pay cheque, these Malaysians say higher salaries have not necessarily translated into financial comfort.

Despite increases in their monthly wages, they said that the rising costs of food, housing as well as new financial commitments have greatly impacted their spending power and savings.

Roslan Zulkifli, 34, who is an analyst at an agricultural firm, found that his disposable income had not improved much despite him earning more than twice his first drawn salary of RM2,000 in his first job as a supervisor at a chicken farm in Selangor.

“Although my current salary has increased a lot since then, my food and transport expenses and other commitments have made it challenging for me to get by each month,” said the father of two.

These days, he said he had to do careful budgeting.

“My finances weren’t entirely comfortable back then but since my previous workplace was in a rural district, the cost of food was manageable,” said Roslan, who is an agriculture and animal science graduate.

A logistics senior executive, who wanted to be known only as Mustafa, said that increasing costs are inevitable.

“So I would always look for cheaper options to keep my expenses down.

“I was able to sustain a decent living during my early working years.

“But later, I had to relocate to Klang Valley for my job, so there are little to no savings left,” said the 36-year-old from Pahang.