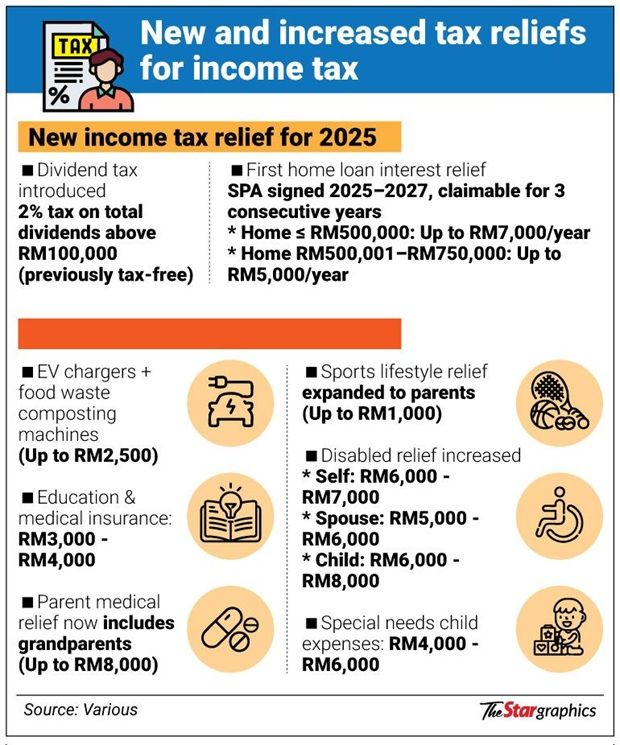

PETALING JAYA: Malaysians filing their tax returns this year will get several new and expanded reliefs but they have to watch out for one new taxable income as well.

Income from dividends is no longer fully exempted.

“This is the first year dividend tax applies,” said accounts and tax expert Datin Christine Koh.

“A 2% tax is imposed on total dividend income exceeding RM100,000 in a year, regardless of how many companies it comes from. Many taxpayers may overlook this because dividends were previously tax-free,” she said.

On the relief side, Koh said families and caregivers stand to benefit the most from changes.

Among the key expansions is the RM8,000 parent medical expenses relief, which now includes grandparents.

Sports-related lifestyle relief of up to RM1,000 has also been widened to cover expenses incurred for parents, not just self, spouse or children.

There are also higher relief limits for persons with disabilities.

Relief for disabled individuals has risen from RM6,000 to RM7,000, for a disabled spouse from RM5,000 to RM6,000, and for a disabled child from RM6,000 to RM8,000 per child.

Education and medical insurance relief has been increased to RM4,000 while the environmental sustainability relief of up to RM2,500 has been expanded to include food waste composting machines, claimable only once between assessment years 2025 and 2027.

Despite the expanded list, Koh warned that many taxpayers still miss out on savings due to misunderstandings.

“Common errors include assuming both parents can claim childcare relief, when only one is allowed, or thinking sports equipment purchased for parents is not claimable.

“Dental examination and treatment expenses of up to RM1,000, claimable since 2024, are still widely overlooked,” she said.

Skill enhancement courses are another area often under-claimed.

“Courses ranging from recognised professional qualifications to language, creative skills and even online wellness programmes, can be claimed under education or lifestyle reliefs, depending on their nature,” she said.

However, Koh noted that while the reliefs help, they only go so far in easing cost pressures.

Tax reliefs reduce tax payable, not actual spending.

“At a 20% tax rate, spending RM1,000 only saves RM200 in tax. The remaining RM800 is still a real cash outflow.

“The RM9,000 personal relief works out to about RM25 a day – far from enough to cover basic necessities,” she said.

First-time homebuyers should also take note of the newly-introduced housing loan interest relief.

Tax expert Datuk Koong Lin Loong said the relief applies to loan agreements signed between Jan 1, 2025 and Dec 31, 2027.

“If the property price is RM500,000 or below, taxpayers can claim up to RM7,000 a year while for homes priced above RM500,000 and up to RM750,000, they can claim up to RM5,000 a year for three consecutive years.

“For example, if a loan is signed at the end of 2027, the tax relief can carry on to 2029,” he said.