KUALA LUMPUR: House prices continued to grow more moderately in the first half of 2018 at 4%, with preliminary data for Q3 2018 suggesting a further moderation to 1.1%, Bank Negara said.

It said the easing in house price growth has been reflective of weaker demand for properties in the higher-priced segments which remain unaffordable for most buyers, and subdued activity in the housing market over the last six years.

“This is contributing to adjustments in housing supply towards more affordable segments in the past two years with an increasing share of new housing launches targeting properties priced below RM500,000,” it said in its Financial Stability and Payment Systems Report 2018 issued on Wednesday.

From January to September 2018, despite fewer launches of new housing units, higher activity in this price segment across key states supported a marginal growth in the total volume of housing transactions.

In other states, house prices at this level are, however, still unaffordable. This contributed to the further increase in the stock of unsold housing units by 22.5% in the nine months to September 2018.

“Despite this, a large and broad-based decline in house prices which could increase risks of a disorderly correction in the housing market is not expected for several reasons,” it said.

Bank Negara said broad house price movements are largely driven by landed residential property transactions (76% of MHPI weightage) which continue to experience firm demand.

Demand for housing is also expected to remain supported by continued income growth and formation of new households.

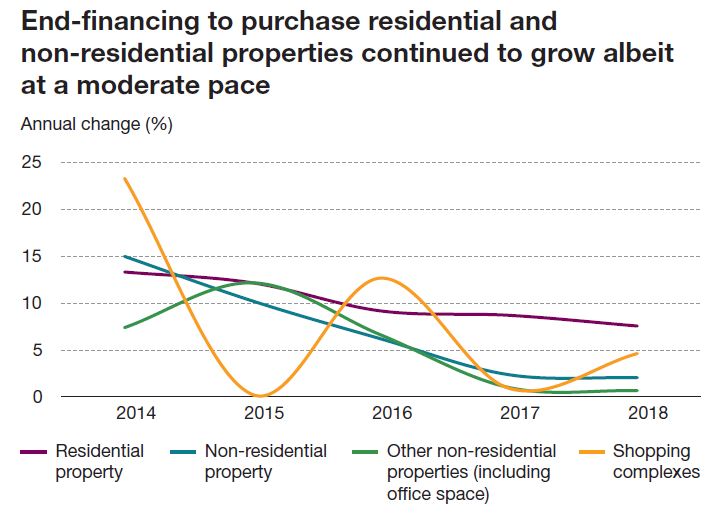

“Affordability remains an issue in the residential property market, while oversupply of office and retail space persists in the non-residential property market.

“Houses priced above RM250,000 continued to form the bulk of new launches and total unsold housing units, adding to the housing supply and demand mismatch in some locations.

“With firm demand for affordable homes continuing to outstrip new supply in the foreseeable future, coupled with measures to improve financing affordability, the outlook for the housing market is expected to gradually improve along with greater alignment between demand and supply conditions,” it said.

Bank Negara said in the non-residential property segment, market activity was subdued in the first nine months of 2018.

The commercial segment, which comprises shops, as well as office space and shopping complexes (OSSC), recorded higher transaction volumes and values, in particular for properties priced above RM500,000.

Higher transactions in the industrial segment were driven mainly by properties priced RM1mil and above.

“Notwithstanding the uptick in market activity in the commercial segment, the large incoming supply of new and planned office space in the Klang Valley and retail space nationwide is expected to exacerbate existing oversupply,” it said.

This was despite the moderation observed in the loan approval rate for the construction of OSSC to 73.1% (2017: 79.7%).

“There remains a risk that these additional commercial spaces would remain unabsorbed, given the continued deterioration in vacancy rates even at current levels of supply, and potential headwinds to the domestic economy,” it said.

Bank Negara pointed out that with the average rental rate of office space in the Klang Valley remaining depressed, risks of property prices adjusting sharply lower remain elevated.

It also highlighted that building owners continued to offer generous incentives to increase tenant demand, including rent holidays and discounts to asking rents.

“Such inducements will likely further depress effective rental rates,” it said.

Limited time offer:

Just RM5 per month.