Johor Plantations Group Bhd resumed its recovery yesterday as it attempted to retrace higher from a mid-January correction.

resumed its recovery yesterday as it attempted to retrace higher from a mid-January correction.

The share is staring at the 50-day simple moving average (SMA) overhead, which poses as an obstacle as it makes its way towards a resistance of RM1.65. A higher price target is seen at the historical trading high of RM1.74.

On the lower end of the price chart, support levels are found at RM1.43 and RM1.31.

Looking at the technical indices, the slow-stochastic has dipped to 30 points while the 14-day relative strength index (RSI) is approaching the midline at 47 points.

The daily moving average convergence/divergence (MACD) line has also charted a fourth successively higher positive bar to signal growing bullish momentum.

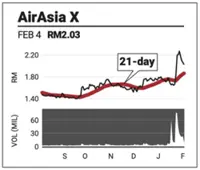

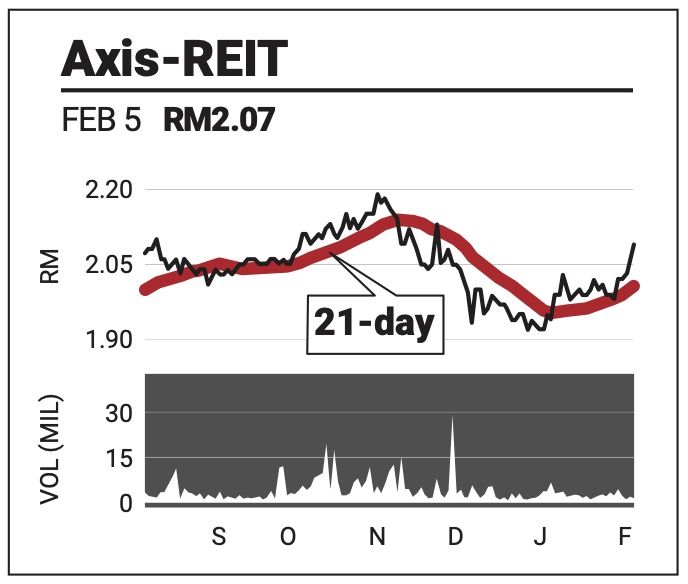

Axis Real Estate Investment Trust moved past the 100-day SMA line yesterday as it extended a rally for a third successive day.

moved past the 100-day SMA line yesterday as it extended a rally for a third successive day.

The counter has retraced more than 50% of the losses recorded during a November-December 2025 correction phase, suggesting ongoing recovery.

Overhead, the share should see resistance at RM2.19, which serves as the pre-correction peak, and proceed to a multi-year high of RM2.25.

The slow-stochastic is currently overbought at 87 points, but remains rising, while the RSI is at a strong 65 points. The MACD is also signalling growing bullish momentum.

Support is found at RM1.90 and RM1.71.

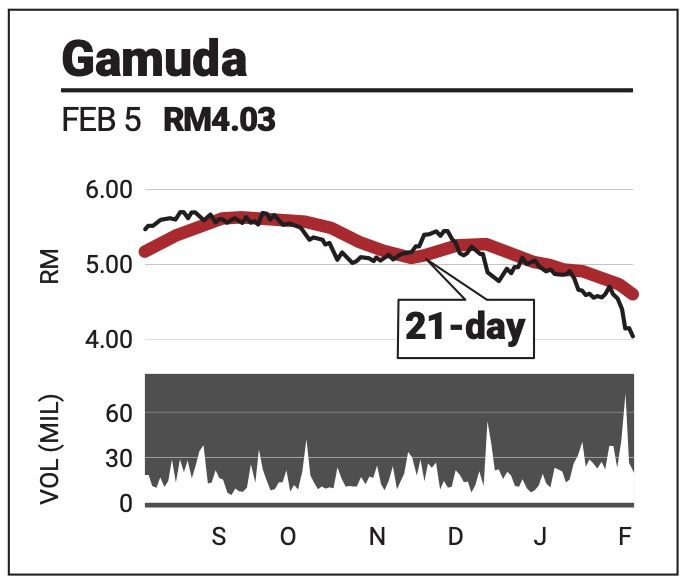

Gamuda Bhd 's decline is showing signs of slowing after correcting about 30% from a closing high of RM5.70 in August 2025.

's decline is showing signs of slowing after correcting about 30% from a closing high of RM5.70 in August 2025.

At present, the share is heading towards a support of RM3.85 and firmer platform at RM3.48, which could trigger a rebound on bargain-hunting activities.

The technical indicators, which have exhibited strong negative momentum in recent days, are currently oversold.

The slow-stochastic is oversold, and flattening out out to suggest a turn towards positive growth. The RSI is also oversold and remains descending at 21 points. The MACD, meanwhile, continues to exhibit falling momentum.

The comments above do not represent a recommendation to buy or sell.