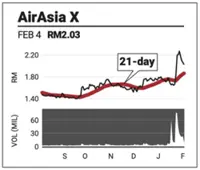

AirAsia X Bhd ’s recent share price movement has taken on a bullish flag formation, which could signal a return to a rally in the near-term.

’s recent share price movement has taken on a bullish flag formation, which could signal a return to a rally in the near-term.

Based on the daily price chart, the share could be halting the decline if it finds support at the RM2 level.

On the upside, the share is looking at surpassing the recent high of RM2.27 and arriving at a 2023 high of RM2.49.

The slow-stochastic has descended to 27 points but the 14-day relative strength index (RSI) remains bullish at 59 points.

The daily moving average convergence/divergence histogram has registered slowing momentum amid the profit-taking.

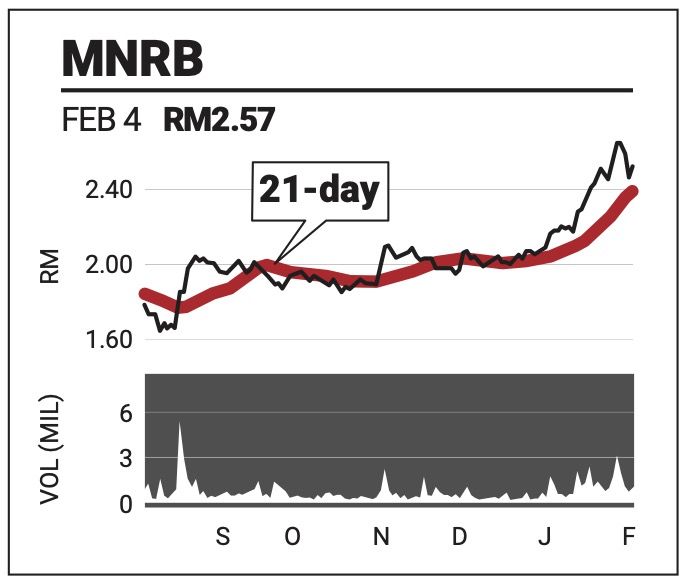

MNRB Holdings Bhd bounced off the 21-day simple moving average (SMA) line yesterday after two days of profit-taking.

bounced off the 21-day simple moving average (SMA) line yesterday after two days of profit-taking.

This could mark the end of the correction phase as the share resumes its place above the uppermost 14-day SMA line, and proceeds to reclaim lost ground.

The resistance is pegged to a recent high of RM2.70, a crossing of which could see a continued rally to RM2.88. Support meanwhile is found at RM2.40 and RM2.20.

The technical indices are mixed as the slow-stochastic remains in a downward trajectory at 42 points, while the RSI is rising at a strong 65 points.

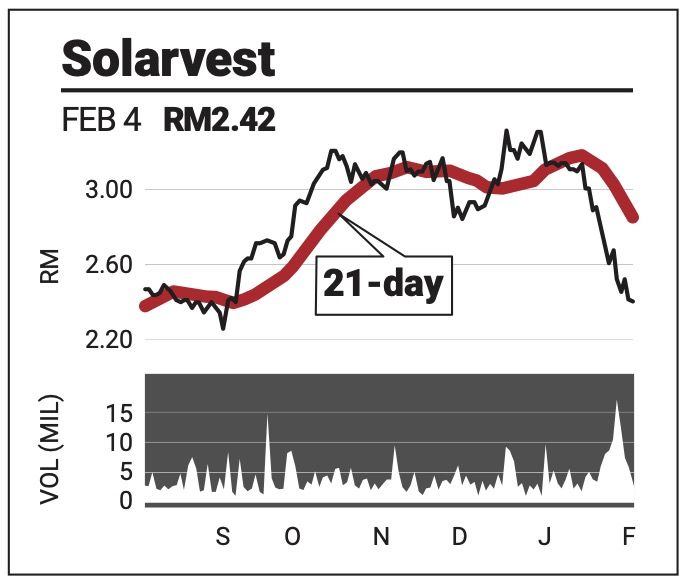

Solarvest Holdings Bhd remains deeply rooted in a correction phase, having slipped below the 200-day SMA line recently and is now hovering just above a support level of RM2.20.

remains deeply rooted in a correction phase, having slipped below the 200-day SMA line recently and is now hovering just above a support level of RM2.20.

However, the shrinking volume could be an indication of the share’s selling phase coming to an end.

Should the share begin its recovery, resistance is found at RM2.90 and RM3.30.

A fall through RM2.20 could see the share approach RM1.90.

The share’s technical indicators reflect weak but rising momentum, with the slow-stochastic at 21 points and the RSI at 27.