Kim Loong Resources Bhd gapped up yesterday as it found new bullish momentum to continue its rally. At the close yesterday, the share came within striking distance of a historical trading high of RM2.20 hit earlier in the week.

gapped up yesterday as it found new bullish momentum to continue its rally. At the close yesterday, the share came within striking distance of a historical trading high of RM2.20 hit earlier in the week.

With the ongoing buying interest, the share is expected to cross the resistance to chart even higher.Looking at the technical indicators, the slow-stochastic crossed the 50-point level yesterday to signal strong bullish momentum.

The 14-day relative strength index (RSI) hit 63 points while the daily moving average convergence/divergence (MACD) histogram is on the verge of turning positive.Support for the share is found at RM2.03 and RM1.94.

CTOS Digital Bhd remains on a rising trend even as it pauses for breath while the technical indicators neutralise. The share was seen spiking to a new recent trading high of RM1.54 yesterday although it eased at the close.

remains on a rising trend even as it pauses for breath while the technical indicators neutralise. The share was seen spiking to a new recent trading high of RM1.54 yesterday although it eased at the close.

However, the share can be seen rising to a resistance of RM1.58, which in crossing would pave the way for a return to a one-year high of RM1.80.Some consolidation pressure is seen from the slow-stochastic, which has turned lower, but remains robust at 73 points.

The RSI is also bullish at 66 points while the MACD histogram continues to chart higher positive bars.Support is pegged to RM1.44 and RM1.39.

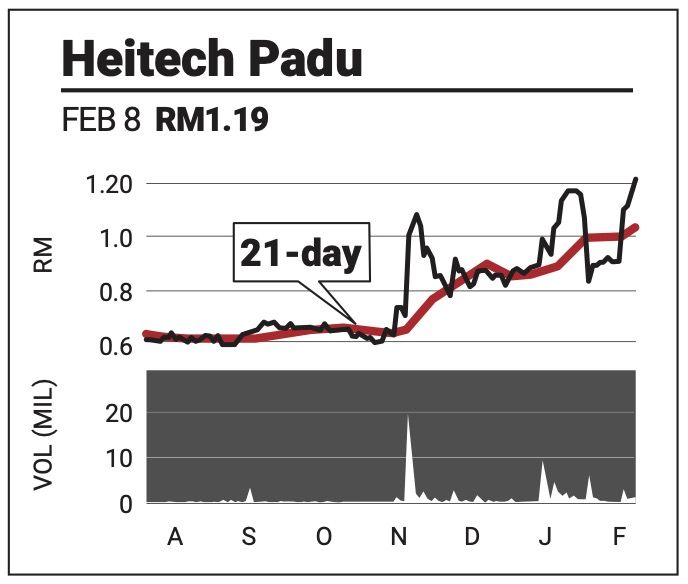

Heitech Padu Bhd has been on a rally over the last five sessions, surpassing a recent high to chart a one-year peak. The stock is expected to continue its bullish momentum towards RM1.40, and RM1.80 above that.

has been on a rally over the last five sessions, surpassing a recent high to chart a one-year peak. The stock is expected to continue its bullish momentum towards RM1.40, and RM1.80 above that.

While the slow-stochastic is overbought it remains afloat at 94 points, while the RSI is growing stronger at 68 points.

The MACD histogram has been growing more positive over the last three sessions, signaling an uptrend.Support lies at RM1.05 and 75 sen.

The comments above do not represent a recommendation to buy or sell.