LAST year, many Malaysians experienced an increase in their medical and health insurance/takaful (MHIT) premiums due to rising medical costs in Malaysia. In response to concerns raised by policyholders, Bank Negara Malaysia (BNM) introduced interim measures aimed at easing the financial burden and ensuring continued MHIT coverage.

However, these measures are temporary and serve as a short-term solution.

The big question for many, especially those who did not make a claim, is, “Why are premiums rising?”

MHIT products are designed based on the principle of pooling risks between different individuals to distribute the cost of claims and reduce the financial burden of each individual. When the total claims made by policyholders in the pool increase, premiums must be adjusted for everyone.

This is essential to maintain the long-term sustainability of the policy and ensure that claims can continue to be paid reliably in the future.

Premium hikes arising from medical inflation tend to be higher when:

> The pool of policyholders is small, leading to more volatile claims experience;

> There is a higher proportion of older age groups in the pool;

> Products offer high annual or lifetime limits, which may lead to higher claims due to higher utilisation arising from over treatment; and

> Products have not been reviewed for a long time and require a higher price adjustment to reflect the actual claims cost.

Recent years have brought pressure on both sides of the equation — costlier treatments and more frequent use of healthcare services.

For instance, the number of claims has more than doubled from 11 per 100 policyholders in 2018 to 25 in 2023.

At the same time, the total cost of MHIT claims jumped 73% between 2021 and 2023, far outpacing the 21% growth in MHIT premiums collected.

Hospital supplies and services such as drugs, laboratory tests and consumables make up between 59% and 70% of private hospital bills. These remain unregulated, with prices varying widely across hospitals.

But now, who is to blame for the high premiums? Arguably, no single party — or everyone. The reality is a system under pressure, and a reform in the private healthcare sector is needed.

Instead of pointing fingers, stakeholders are being urged to work together to make private healthcare more accessible and sustainable.

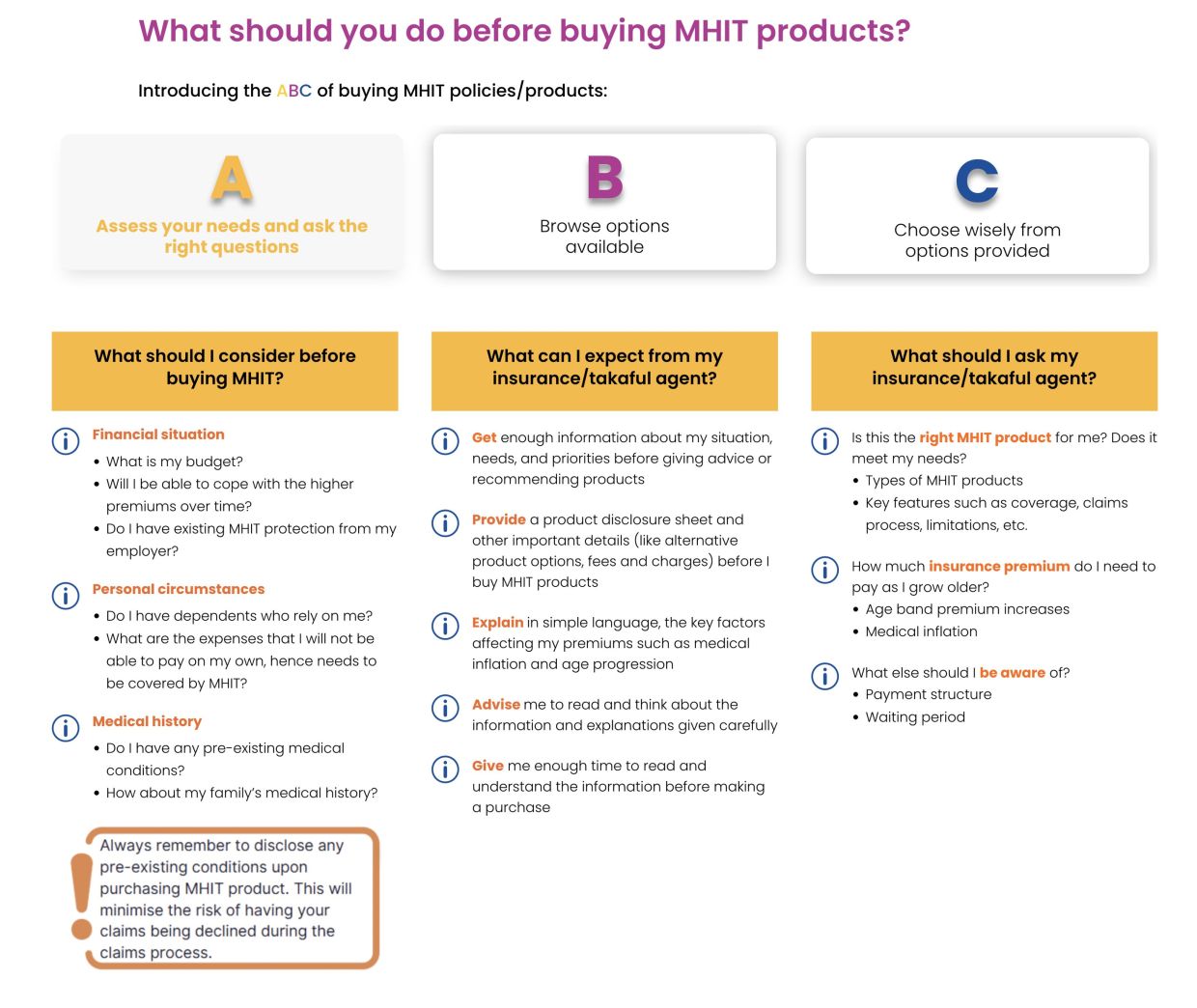

In addition, initiatives have been implemented to enable consumers to make informed decisions and anticipate future healthcare expenditures. For example, guidance on selecting a suitable MHIT product is available on the Financial Education Network's website.

This initiative aims to encourage consumers to carefully assess their needs and financial circumstances, enabling them to select the most suitable option.

Resetting the system

At the forefront is the “RESET” blueprint, a collaborative effort by the Finance Ministry (MOF), Health Ministry (MOH), BNM and key stakeholders, a strategy to curb rising medical inflation and reform the private healthcare system.

The RESET blueprint seeks to address the issue holistically, recognising that the healthcare ecosystem spans a complex value chain.

It lays out 11 initiatives under five strategic thrusts, targeting improvements from the perspective of payors, providers and patients.

> Revamp MHIT offerings by developing a base MHIT product to support value-based healthcare services focusing on overall patient outcomes, optimising cost-effective healthcare services and enhancing access to quality care.

> Enhance price transparency to help patients and payors make informed decisions, alongside a mechanism to better monitor medical inflation.

> Strengthen digital health systems by improving interoperability of electronic medical records across hospitals to boost efficiency.

> Expand cost-effective healthcare facilities to widen access.

> Transform payment mechanisms by implementing a diagnosis-related groups (DRG) model which focuses on patient outcomes to replace the fee-for-service system.

The Joint Ministerial Committee on Private Healthcare Costs (JBMKKS), led by the finance and health ministries, will oversee implementation and ensure continuous engagement with stakeholders.

Base MHIT product

Rising medical inflation and cost spirals have highlighted the need to further evolve MHIT product offerings to better meet the needs of customers.

Therefore, a key initiative under RESET is to review MHIT offerings through the development of a base MHIT product which will be co-developed by BNM and the MOH with support from insurers, takaful operators and private healthcare providers.

This base product is envisioned to provide a foundational layer of protection for individuals to finance medical expenses for essential healthcare needs. Individuals can also purchase additional coverage if they wish to do so.

The additional coverage will be aligned with the foundational base product in terms of core design principles that promote sustainability, transparency and responsible use, while leaving room for insurance and takaful operators (ITOs) to innovate through competitive offerings to meet the needs of different policyholders.

Designed as an affordable, voluntary option for essential private healthcare coverage, it will be standardised across all ITOs to create a broader risk pool, improving pricing predictability and long-term affordability.

The base MHIT product’s design focuses on three key areas:

> Benefits package: Balancing affordability and accessibility while ensuring meaningful financial protection for the wider population is important. While comprehensive benefits are highly valued, it's important to recognise that higher coverage inevitably comes with higher premium costs. To keep premiums affordable and sustainable, benefit designs must be thoughtfully calibrated, covering essential services that meet diverse needs without compromising long-term sustainability.

> Sustainable pricing model/strategy: Ensuring the financial viability of the base product over time, potentially through savings mechanisms or a prefunding strategy to support long-term sustainability and smooth premium payments over time.

> Payment and operating model with cost-containment measures: Exploring alternative healthcare payment models such as Diagnosis-Related Groups (DRG) and strategic purchasing for private healthcare services, which can incentivise efficiency and better health outcomes. At the same time, exploring a larger role in primary care and ambulatory care could help in managing overall healthcare costs more effectively.

Consultations with stakeholders are currently underway to ensure that all perspectives are carefully considered and aligned with the principles of affordability and long-term sustainability of the base MHIT product.

These engagements are important in shaping a comprehensive and inclusive approach to the product's development. The conceptual design of the base MHIT product is targeted for completion by year-end, setting the stage for its rollout, which is planned for the end of 2026.

What can we expect from RESET

As the RESET blueprint unfolds, it offers hope for a more equitable healthcare system that prioritises the needs of patients, ensures fairness for payors and promotes responsible practices among providers.

For Malaysians, this marks a crucial milestone in tackling the challenges of escalating premiums and making private healthcare a viable and sustainable option for all, ultimately safeguarding the long-term well-being of individuals and families across the country.

Furthermore, the RESET blueprint complements Malaysia's public healthcare system by bridging gaps in affordability and accessibility within private healthcare, thereby easing the strain on public facilities and fostering a more balanced and collaborative healthcare ecosystem.