KPJ Healthcare Bhd rose for a third consecutive day to a fresh record high yesterday as it defied the weak broader market sentiment.

rose for a third consecutive day to a fresh record high yesterday as it defied the weak broader market sentiment.

The share has outpaced the key simple moving averages (SMA), suggesting a pick-up in the bullish momentum even as the technical indicators continues to push higher in overbought conditions.

The slow-stochastic has risen to 92 points, but remains in a healthy upward trajectory while the 14-day relative strength index (RSI) has crossed into overbought territory at 71 points.

Further affirming the growing bullish momentum, the daily, moving average convergence/divergence (MACD) histogram continues to chart consecutively higher bars.

While the share is expected to reach further into uncharted territory, the support levels are seen at RM2.54 and RM2.37.

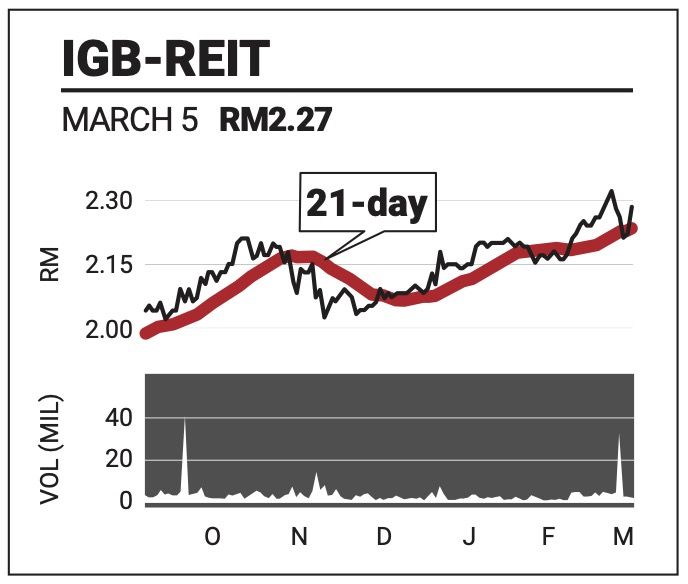

IGB Real Estate Investment Trust remains supported by the short-term SMA lines after experiencing selling pressure in recent days.

remains supported by the short-term SMA lines after experiencing selling pressure in recent days.

The share is expected to return above the recent trading high of RM2.34, which also represents a historical high, to resume an uptrend.

There are indications the rally has resumed with the slow-stochastic bouncing off the oversold line to cross into a bullish signal.

The RSI is also rising in bullish fashion to a strong 57 points.

Meanwhile, the MACD histogram is charting shorter negative bars as it turns positive.

Support is pegged to RM2.13 and RM2.

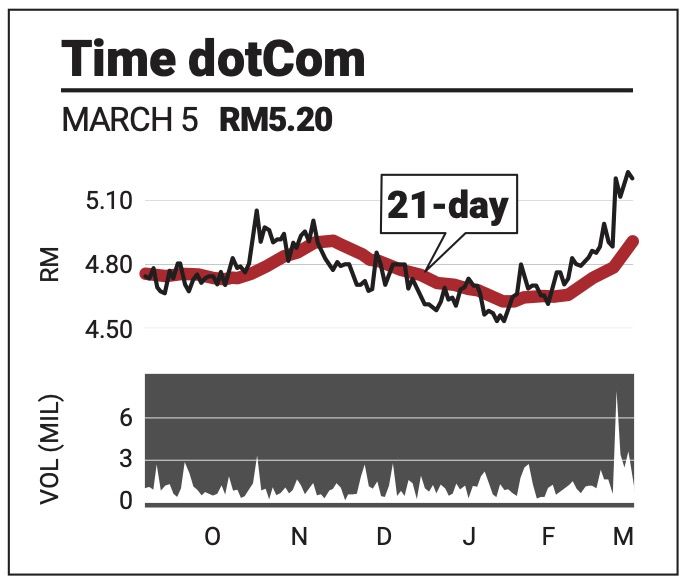

TIME Dotcom Bhd is experiencing some consolidation pressure below recent trading high of RM5.29.

is experiencing some consolidation pressure below recent trading high of RM5.29.

Profit-taking activities are thwarting attempts to reclaim the high point as investor cash in on the stock's strong gains in February.

Nevertheless, the bullish trend remains intact, and should continue after a brief period of consolidation.

The slow-stochastic is slowing its ascent at 73 points , suggesting the onset of consolidation. while the RSI has fallen below the overbought line at 68 points.

The MACD remains bullish, but charted a slightly shorter positive bar yesterday to reflect the slowing growth.

Support lies at RM5 and RM4.51.

The comments above do not represent a recommendation to buy or sell.