Malaysia Smelting Corp Bhd (MSC) has surged over the last four days to a fresh multi-year high, indicating that the bullish trend is well and intact.

Bhd (MSC) has surged over the last four days to a fresh multi-year high, indicating that the bullish trend is well and intact.

With the sharp improvement in momentum, the slows-stochastic and 14-day relative strength index (RSI) have moved to overbought levels, but remains healt hy given their ongoing ascent.

The daily moving average convergence/divergence (MACD) histogram has also signalled bullish momentum with a spike into positive territory.

There is resistance at RM2.11 and RM2.53, while support lies at RM1.69 and RM1.47.

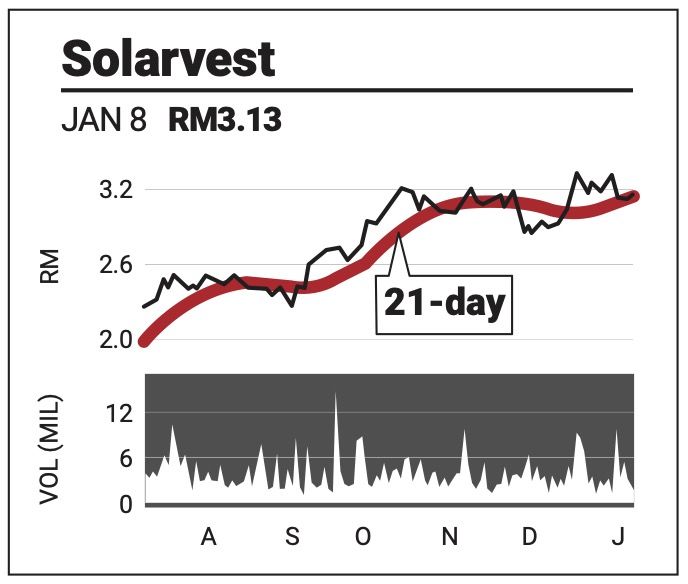

Solarvest Holdings Bhd ’s correction in the first trading day of this year has eased into a consolidation phase as the share bides its time to resume a rally.

’s correction in the first trading day of this year has eased into a consolidation phase as the share bides its time to resume a rally.

At present, the share is moving in a sideways pattern and supported by the 50-day simple moving average (SMA).

The declining momentum on the technical indices has levelled out, suggesting that the present weakness could be ending soon. The slow-stochastic is currently edging higher at a low 24 points while the RSI remains firm at 50 points.

The onset of a buying catalyst could take the share to the recently charted historical trading high of RM3.39. Support lies at RM2.68 and RM2.40.

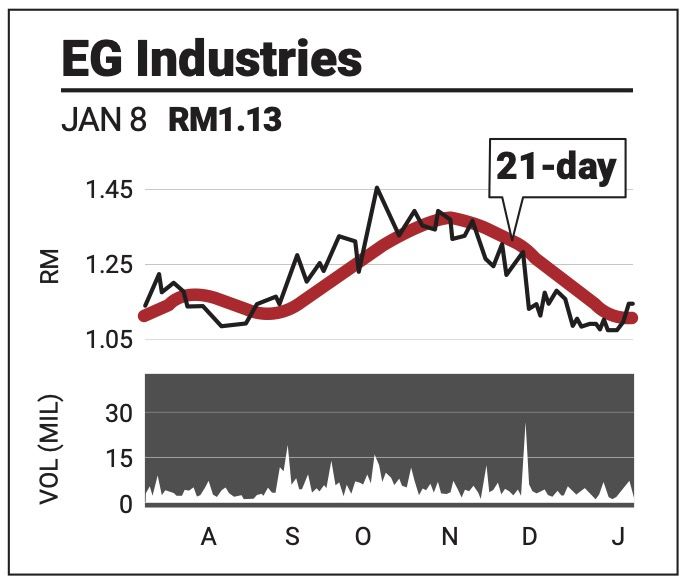

EG Industries Bhd is climbing out of a three-month correction, with recent gains suggesting improving sentiment.

is climbing out of a three-month correction, with recent gains suggesting improving sentiment.

However, there has yet to be a catalyst to trigger significant buying volume, suggesting that a sustained recovery remains elusive.

The slow-stochastic has risen to 72 points and the RSI remains firm at 50 points. The MACD histogram is also charting successively higher positive bars.

Over the coming term, the share’s ascent will meet with the descending 50-day SMA line and uppermost 100-day SMA line. Resistance is pegged to RM1.20 and RM1.35 while support rests at RM1.05 and 80 sen.