British American Tobacco (M) Bhd has been trending higher over the last four weeks, challenging the 100-day simple moving average (SMA) yesterday in a sign of bullish sentiment.

has been trending higher over the last four weeks, challenging the 100-day simple moving average (SMA) yesterday in a sign of bullish sentiment.

Should the share overcome this obstacle, it could climb higher, making an initial stop at RM7.40 before rising to a six-month trading high of RM8.25.

The slow-stochastic has crossed below the overbought line to indicate a consolidation phase has started, although the robust momentum in other indicators point suggest the recovery will continue.

The 14-day relative strength index (RSI) is at 69 points while the daily moving average convergence/divergence (MACD) histogram is charting more positive bars.

Support is found at RM6.34 and RM5.90.

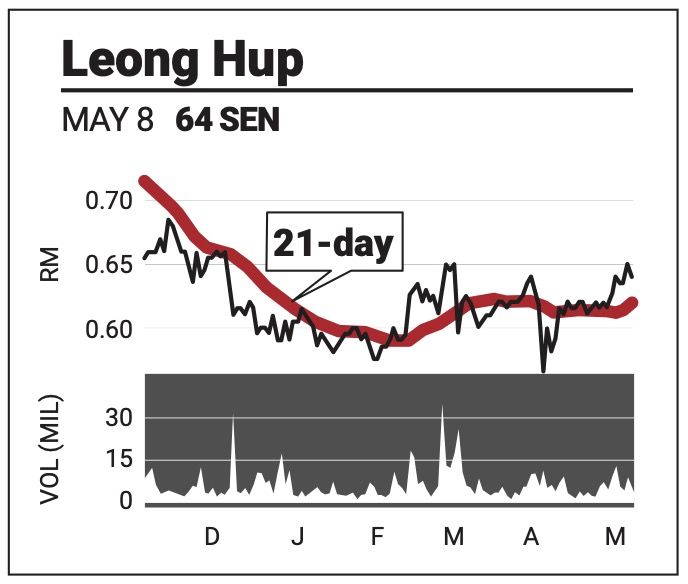

Leong Hup International Bhd is yet to confirm a breach of the 200-day SMA line as it failed to extend its lead above the hurdle yesterday in profit-taking mode.

is yet to confirm a breach of the 200-day SMA line as it failed to extend its lead above the hurdle yesterday in profit-taking mode.

The descending slow-stochastic indicates the share has started consolidating although there remains a healthy level of positive momentum.

In other indices, the RSI has descended to 57 points while the MACD histogram continues to trend higher.

The share will achieve a higher high past 66.5 sen, and pace higher towards 77.5 sen.

Support lies at RM62 sen and 56 sen.

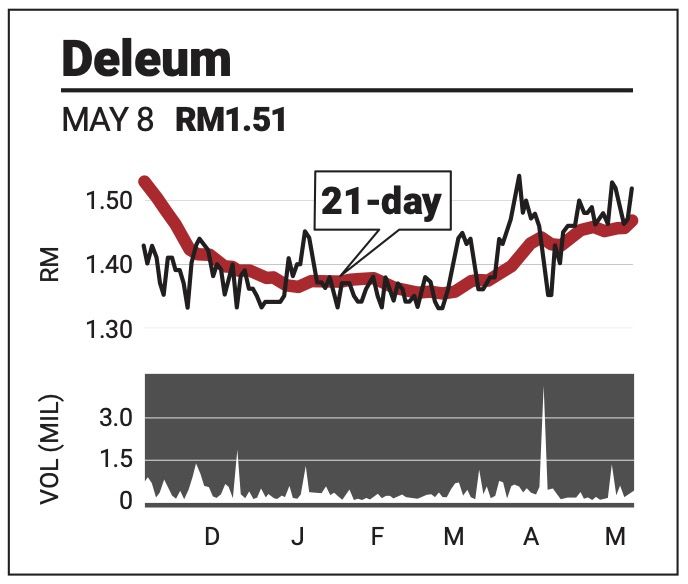

Deleum Bhd has risen, above the 14- and 21-day SMA lines as momentum grows on the technical indices

has risen, above the 14- and 21-day SMA lines as momentum grows on the technical indices

While the slow-stochastic has been recovering at a weak 36 points, the RSI is strong at 56 points while the MACD histogram is displaying a shorter negative bar.

There could be a breakout for the share at RM1.55 level, following which it could rise to a seven-month high of RM1.69.

Support is pegged to RM1.40 and RM1.25.

The comments above do not represent a recommendation to buy or sell.