Genting Bhd could be extending its recovery after a sharp sell-off in the opening days of March.

could be extending its recovery after a sharp sell-off in the opening days of March.

The share is seeing a pick-up in momentum as it heads towards the trading gap on Feb 28, 2025, which in closing would see the share arrive at RM3.70. Incidentally, the target also meets the descending 100-day simple moving average (SMA)

The recent peak of RM3.93 also serves as a higher price target.

Looking at the technical indicators, the slow-stochastic has risen to overbought conditions at 86 points while the 14-day relative strength index (RSI) remains weak at 39 points.

Meanwhile, the daily moving average convergence and divergence (MACD) histogram is seeing a slowing negative trend.

On the lower end of the chart, support is found at RM3.05 and RM2.77.

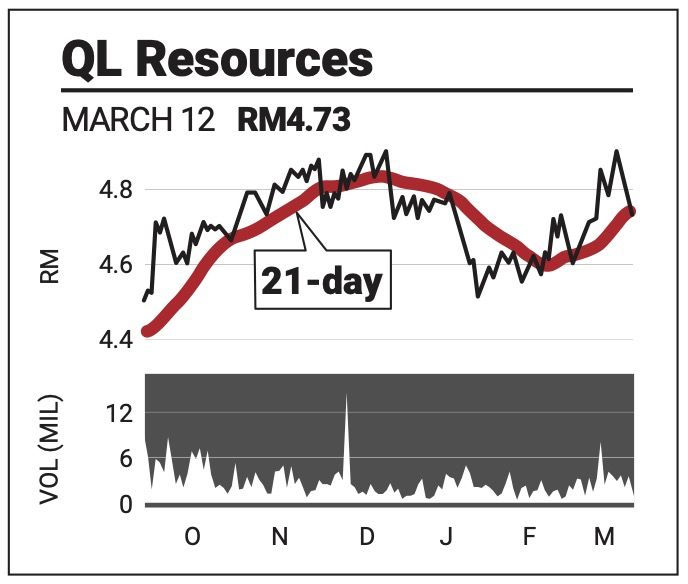

QL Resources Bhd bounced back yesterday to remain above the 50-day SMA line.

bounced back yesterday to remain above the 50-day SMA line.

The share remains on a positive trend although a downturn in the technical indicators is suggesting some profit-taking could be in the books.

The slow-stochastic has fallen to 36 points, suggesting growing weakness in the momentum while the MACD has crossed lower into a negative signal.

For the present, the share looks likely to idle below the resistance of RM4.90, a level that has to be overcome to signal a resumption of the uptrend.

However, the share is also well-supported by the 200-day SMA line, which is currently ascending towards RM4.60.

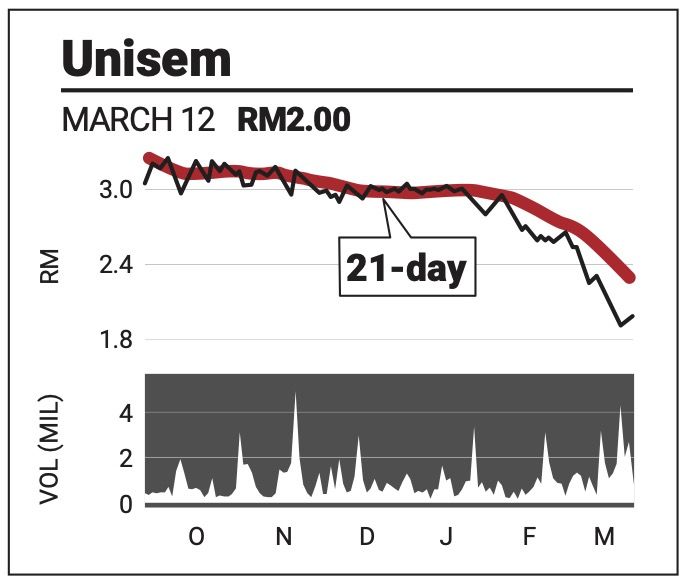

Unisem (M) Bhd 's positive retracement could be picking up speed as the momentum indices turn bullish.

's positive retracement could be picking up speed as the momentum indices turn bullish.

The slow-stochastic has crossed the mid-line to 58 points while the RSI is attempting to rise out of oversold conditions at 27 points.

The MACD histogram is charting shorter negative bars to indicate a gradual return to bullishness.

While the share must first overcome the descending short-term 14-and 21-day SMA lines, it would find stiff resistance levels at RM2.42 and RM3.08.

Support is pegged to RM1.83 and RM1.60.

The comments above do not represent a recommendation to buy or sell.