My EG Services Bhd is extending a recovery after experiencing a correction in the final week of February.

is extending a recovery after experiencing a correction in the final week of February.

The share rallied yesterday to the 14-day simple moving average (SMA) on bargain-hunting.

There remains strong resistance in the form of the descending short-term SMA lines, although the obstacles will be taken out following a successful breach of the 98 sen level, en route to a recent trading high of RM1.06.

The slow-stochastic is in recovery mode, rising to 45 points while the 14-day relative strength index (RSI) is also rising at 50 points.

While the daily moving average convergence/divergence (MACD) histogram remains negative, the bars are shortening to indicate a gradual return to positive territory.

Support is found at 87.5 sen and 80.5 sen.

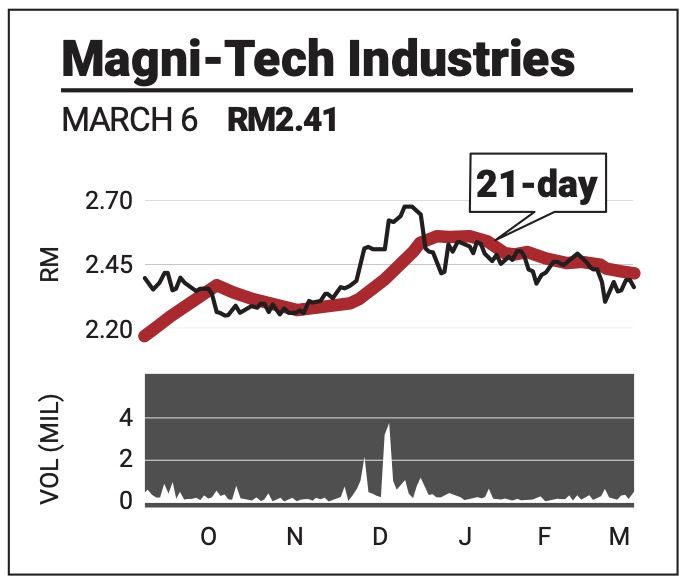

Magni-Tech Industries Bhd attempted to rise above the downtrending 50-day SMA line yesterday but ended the session under the resistance.

attempted to rise above the downtrending 50-day SMA line yesterday but ended the session under the resistance.

With the technical indicators growing more bullish, there could be another attempt in the offing as the share looks to return to a recent high of RM2.68.

The slow-stochastic has entered overbought conditions at 80 points, but remains at a healthy ascent.

The RSI is arriving at the 50-point midline while the MACD histogram has charted its first positive bar.

Support for the share is pegged at RM2.28 and RM2.17.

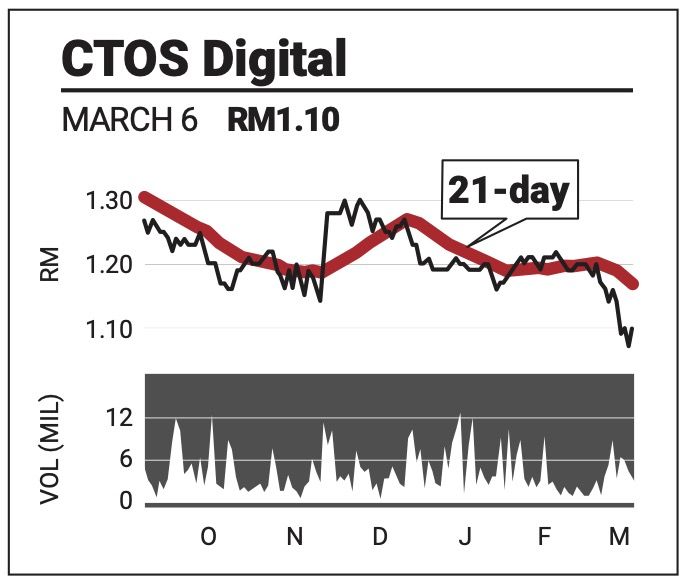

CTOS Digital Bhd could have hit bottom for now as the mild rebound yesterday saw it rise off a historically low closing of RM1.07.

could have hit bottom for now as the mild rebound yesterday saw it rise off a historically low closing of RM1.07.

There is an opportunity to bargain-hunt given the stock's recent losses, with the technical indicators showing an attempt to move out of oversold conditions.

The slow-stochastic stopped its descent to bounce higher at a weak 28 points while the RSI has risen out of oversold territory at 35 points.

The MACD histogram remains deeply negative, although there are signs of improvement in the shrinking negative bar.

In the event of a positive retracement, the share is looking at RM1.16 as the first stop of its recovery, before heading to RM1.22.

The comments above do not represent a recommendation to buy or sell.