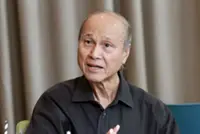

LONDON: HSBC Holdings Plc chief executive officer Noel Quinn (pic) says an executive’s remarks playing down the risk of climate change are “inconsistent” with the bank’s strategy and don’t reflect views of senior management.

“Our ambition is to be the leading bank supporting the global economy in the transition to net zero,” he said in a post on LinkedIn.