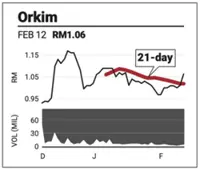

Orkim Bhd breached the 21-day simple moving average (SMA) yesterday as its recovery gained speed after a week of idling.

breached the 21-day simple moving average (SMA) yesterday as its recovery gained speed after a week of idling.

Resistance level is at RM1.09, following which the share could break out towards its historical trading peak of RM1.21.

The technical indicators are looking healthy with the slow-stochastic rising at 62 points and the 14-day relative strength index (RSI) jumping to 60 points.

The daily moving average convergence/divergence (MACD) histogram has charted a sharply higher positive bar, which indicates the onset of strong momentum.

Support for the share is pegged to RM1 and 92 sen.

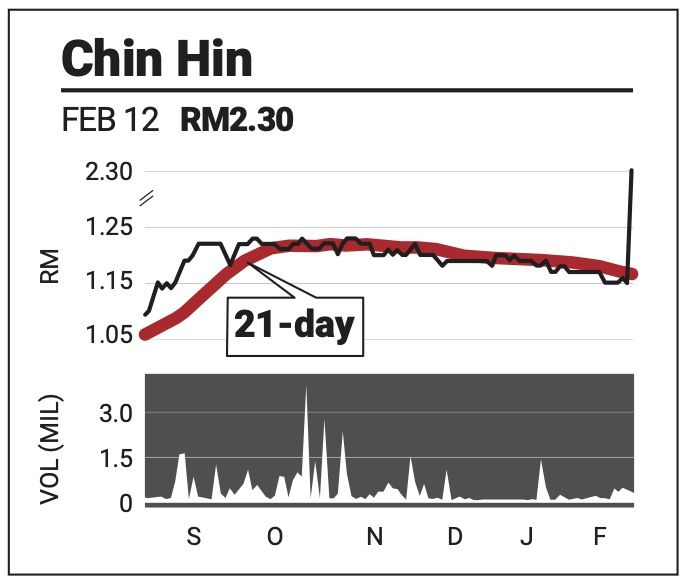

Chin Hin Group Bhd rebounded strongly yesterday after spending six weeks under selling pressure.

rebounded strongly yesterday after spending six weeks under selling pressure.

The share made a beeline for the overhead resistance at RM2.30, which upon crossing, would set it on a more solid footing above the short-term 14- and 21-day simple moving averages. Higher resistance is found at RM2.53.

The technical indices indicate a neutralisation phase with the slow-stochastic rising above the oversold line to 31 points and the RSI bouncing off the oversold line to 51 points.

The MACD has curved higher to suggest the negative momentum is slowing. Support is pegged to RM1.95 and RM1.70.

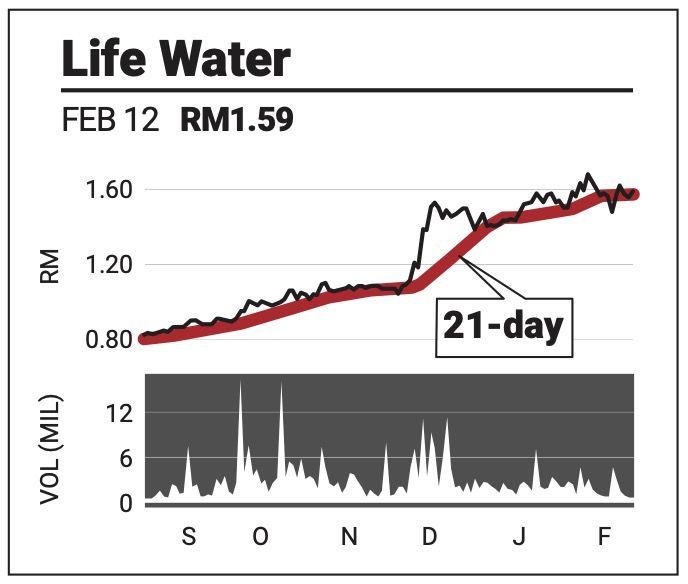

Life Water Bhd is currently trading in a sideways pattern as it awaits a fresh lead to take it to a higher level of trading.

is currently trading in a sideways pattern as it awaits a fresh lead to take it to a higher level of trading.

The technical indices suggest the share is taking a breather as the slow-stochastic neutralises from overbought conditions, dipping to 74 points. The RSI remains strong at 53 points, while the MACD is showing slowing momentum.

Overhead, the share is looking at a historical closing high of RM1.68, with buffers at RM1.40 and RM1.10.