Dufu Technology Corp Bhd gapped above the 50-day simple moving average (SMA) yesterday with active trading volume.

gapped above the 50-day simple moving average (SMA) yesterday with active trading volume.

The share is rising out of a two-month correction, with an initial target of RM1.93 as it attempts to reclaim a recent peak of RM2.25.

There is a notable uptick in buying momentum, with the slow-stochastic rising to 81 points and the daily moving average convergence/divergence (MACD) histogram charting a sharply higher positive bar.

Support for the share is pegged to RM1.57 and RM1.41.

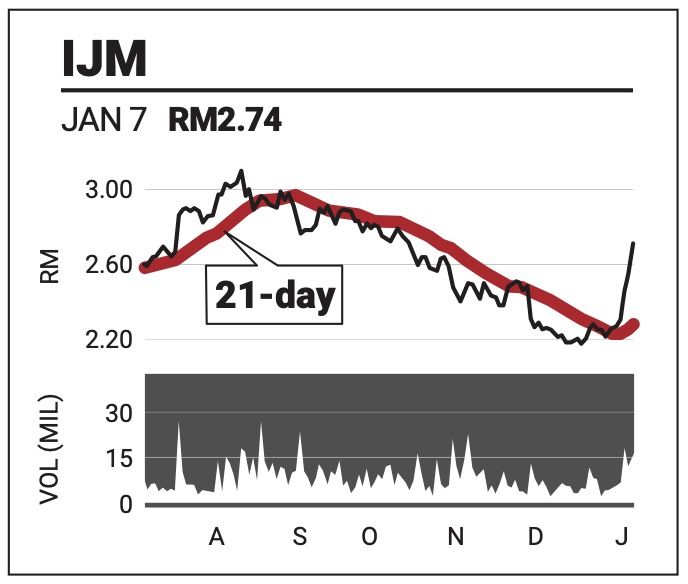

IJM Corp Bhd made a seventh successive day of gains yesterday as its rebound picked up speed.

made a seventh successive day of gains yesterday as its rebound picked up speed.

The share had undergone a steep correction between August and December last year, which now looks to have ended.

On the daily price chart, the share has taken out the uppermost 100-day SMA line on high trading volume, charting more than 50% recovery of the losses made during the correction period.

The technical indicators are overbought, which could lead to some consolidation pressure, but the bullish trend remains intact.

It is currently challenging the resistance at RM2.74, with next resistance at RM3.10. Support is pegged to RM2.37 and RM2.15.

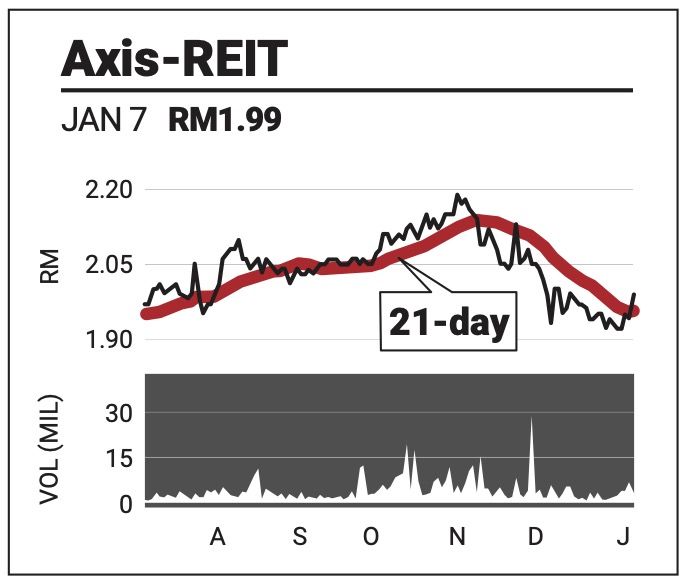

Axis Real Estate Investment Trust is attempting to come out of a correction phase, with an eye towards crossing the 50- and 100-day SMA lines at RM2.05.

is attempting to come out of a correction phase, with an eye towards crossing the 50- and 100-day SMA lines at RM2.05.

A breach of the resistance could lead towards the share's recent trading high of RM2.16, set in November 2025.

The technical indicators are looking healthy, with the slow-stochastic at 74 points and the 14-day relative strength index rising past the 50-point midline.

The MACD is also charting bullish momentum, with successively higher bars.

Support for the share lies at RM1.90 and RM1.81.

The comments above do not represent a recommendation to buy or sell.