Sam Engineering & Equipment (M) Bhd jumped yesterday to break out of a sideways trading pattern and kickstart a recovery trend.

(M) Bhd jumped yesterday to break out of a sideways trading pattern and kickstart a recovery trend.

The share is set to retrace the correction path it underwent in the second half of August, seeking to return to a higher trading target of RM4.48 that was set in May.

The technical indicators are affirming the return of bullish momentum as the slow-stochastic in on the verge of crossing the 50-point midline.

The 14-day relative strength index (RSI) is rising at 51 points while the daily moving average convergence/divergence (MACD) histogram is poised to signal bullish momentum.

Higher resistance is seen at RM5.58 while on the support end, notable levels are RM3.66 and RM2.98.

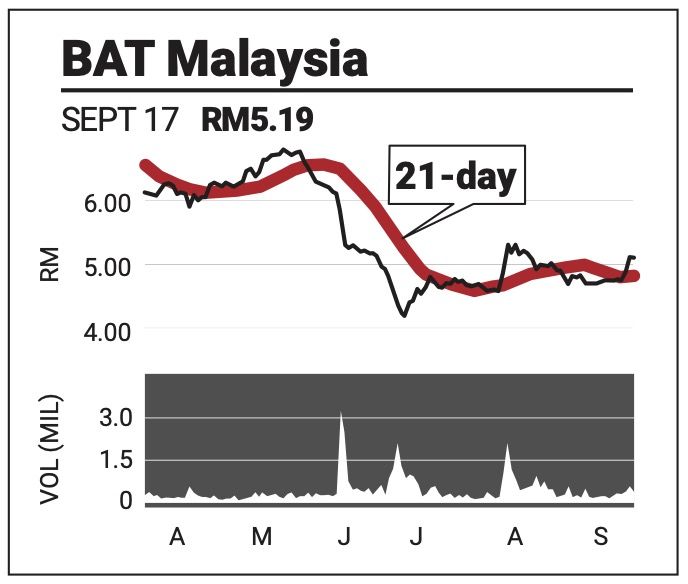

British American Tobacco (M) Bhd rose for a third consecutive day yesterday as it edged closer to the higher end of a consolidation range.

rose for a third consecutive day yesterday as it edged closer to the higher end of a consolidation range.

However, the momentum indices remains in positive mode with the slow-stochastic having risen to an overbought level of 94 points while the RSI gaining at 68 points.

The MACD histogram is also bullish with a third consecutive positive bar.

In the event of a break out, the share could fill in a trading gap at RM5.86 before heading to a four-month trading high at RM6.90.

Support, meanwhile, is pegged to RM4.58 and RM4.18.

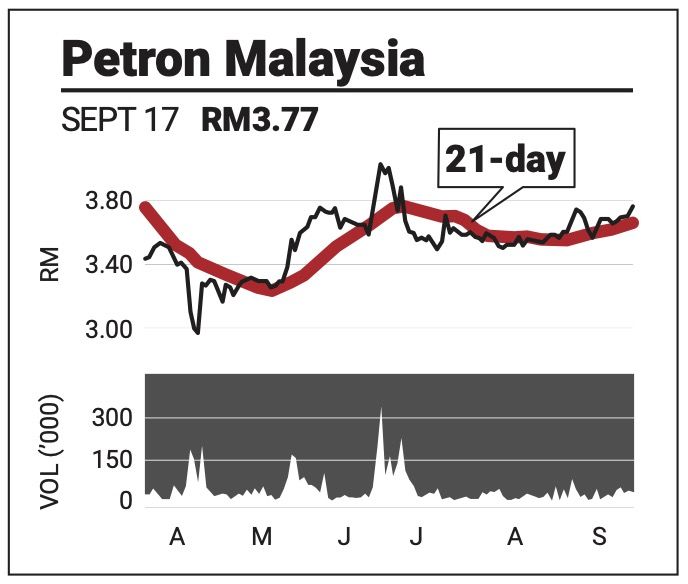

Petron Malaysia Refining & Marketing Bhd traded above the 200-day simple moving average yesterday in a sign that its gradual recovery is picking up speed.

traded above the 200-day simple moving average yesterday in a sign that its gradual recovery is picking up speed.

This could be a sign that the share, which has been idling since end-June, is gaining momentum towards a seven-month high of RM4.10. Further continuation of the uptrend could see the share return to a 14-month high of RM5.

Looking at the momentum indices, the slow-stochastic has neutralised from overbought conditions at a robust level of 70 points. The RSI continues to rise at a strong 65 points, while the MACD histogram has signalled growing bullish momentum with a higher positive bar.

Support lies at a recent low of RM3.51 and RM2.96.

The comments above do not represent a recommendation to buy or sell.