Petron Malaysia Refining & Marketing Bhd is on a steady climb, and fast approaching the 100-day simple moving average (SMA) after four consecutive days of gains.

is on a steady climb, and fast approaching the 100-day simple moving average (SMA) after four consecutive days of gains.

The share is headed towards the 38.2% Fibonacci retracement (FR) level at RM3.84, which in crossing would see it head towards the 61.8% FR at RM4.36.

There is an overbought situation in the technical indices, which suggests a period of consolidation below the 100-day SMA hurdle.

However, the uptrend remains intact with growing momentum in the daily moving average convergence/divergence (MACD) histogram.

Support for the share is pegged to RM3.30 and RM2.96.

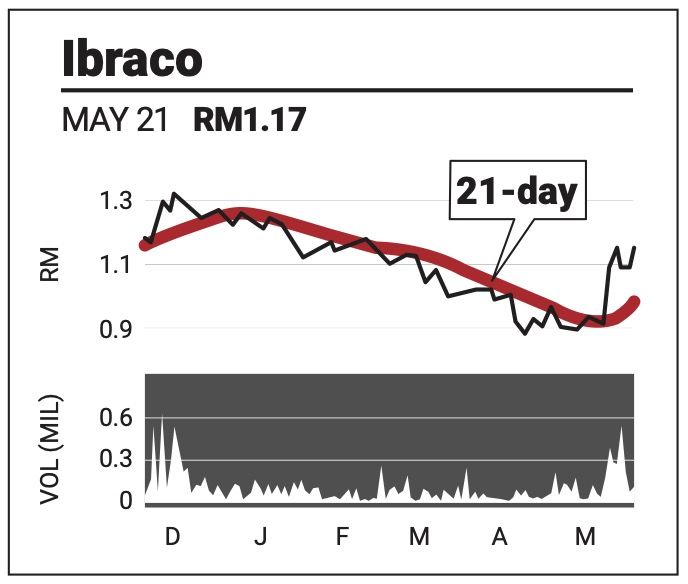

Ibraco Bhd is holding to a sideways trading trajectory, although some upside bias can be seen in the momentum indicators.

is holding to a sideways trading trajectory, although some upside bias can be seen in the momentum indicators.

Yesterday’s rally saw the share rise above the 200-day SMA line.

The technical indices also ticked higher, including the slow-stochastic, which rose to 66 points and the 14-day relative strength index (RSI), which gained to 69 points. The MACD histogram remains on an uptrend.

Upon continuation of the positive trend, the share is expected to cross RM1.20 and head towards a recent trading high of RM1.33.

Support can be seen at RM1 and 85 sen.

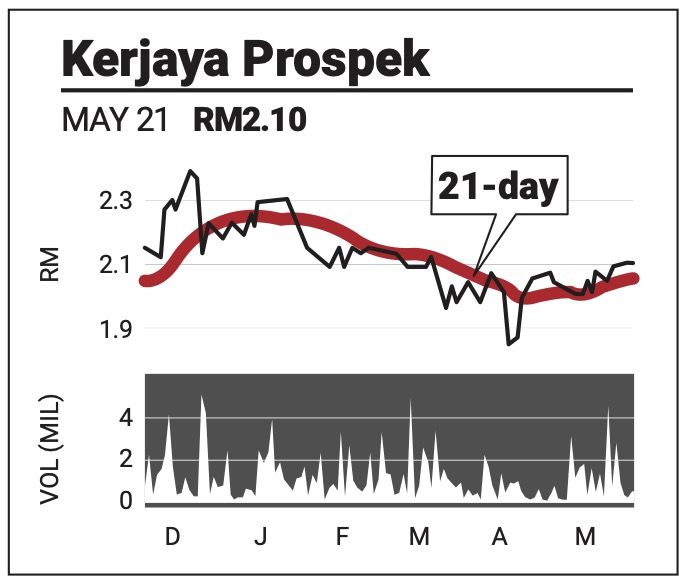

Kerjaya Prospek Group Bhd made an intraday break of the 100-day SMA line yesterday, but failed to maintain the gains at the close of the day.

made an intraday break of the 100-day SMA line yesterday, but failed to maintain the gains at the close of the day.

Should there be a decisive breach of the resistance, the share could aim for a recent high of RM2.41.

The slow-stochastic has descended to 52 points while the RSI is at a strong 59 points. The MACD histogram has also charted another positive bar to signal a rising uptrend. Support can be found at RM2 and RM1.80.