KUALA LUMPUR: Malaysia’s exports in January 2019 rose at a faster-than-expected pace of 3.1% year-on-year (y-o-y) to RM85.4bil, underpinned by expansion in exports to China, Thailand and South Korea, compared with a Bloomberg survey of a 0.6% contraction.

The Statistics Department announced on Monday re-exports were valued at RM17.5bil (+0.4%) and accounted for 20.5% of total exports. Domestic exports increased RM2.5bil or 3.9% to RM67.9bil.

As for imports, they increased by 1.0% y-o-y to RM73.9bil, slightly lower than the Bloomberg survey of a 1.2% increase.

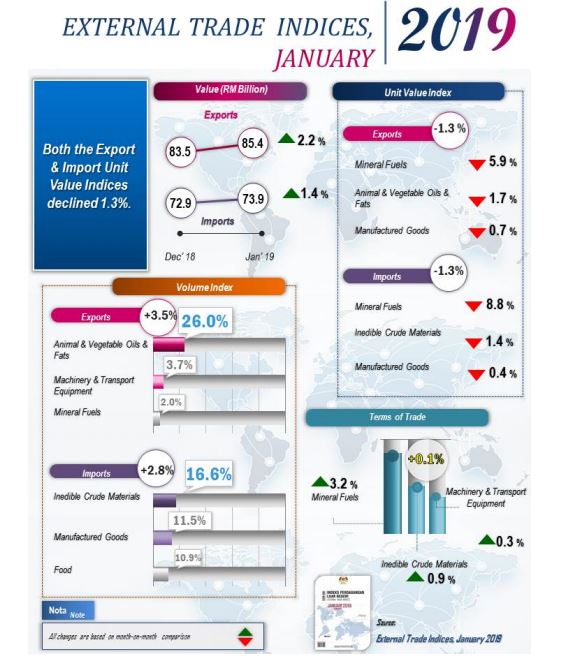

“On a month-on-month (m-o-m) basis, exports increased RM1.9bil (+2.2%) from RM83.5bil. In seasonally adjusted terms, exports registered an increase of 7.9%.

“On a m-o-m basis, imports posted a growth of RM1bil (+1.4%) from RM72.9bil. In seasonally adjusted terms, imports rose 2.6%,” it said.

The department said on a y-o-y basis, export growth was due to higher exports to China (+RM919.4mil), Thailand (+RM823.3mil), South Korea (+RM775mil) and the US (+RM680.8mil).

On a y-o-y basis, higher imports were mainly from China (+RM2.7bil), Saudi Arabia (+RM1.2bil) and Taiwan (+RM696mil).