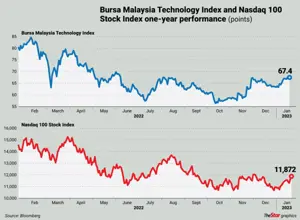

Tech sector on investors’ radar

PETALING JAYA: Technology stocks, which heavily underperformed last year, may be emerging on investors’ radar globally and locally, on bets of less aggressive interest-rate hikes from the US Federal Reserve (Fed).PETALING JAYA: Technology stocks, which heavily underperformed last year, may be emerging on investors’ radar globally and locally, on bets of less aggressive interest-rate hikes from the US Federal Reserve (Fed).

Snap co-founders’ wealth plunges US$3.2bil on profit warning

Like the disappearing “snaps” that users post on its social-media app, Snap Inc’s Evan Spiegel and Bobby Murphy just saw a big chunk of their fortunes vanish.

Explainer: What’s next now that Twitter agreed to Musk bid?

Twitter’s acceptance of Elon Musk’s roughly US$44bil (RM191.29bil) takeover bid brings the billionaire Tesla CEO one step closer to owning the social media platform.

Elon Musk to buy Twitter for US$44bil and take it private

Elon Musk reached an agreement to buy Twitter for roughly US$44bil (RM191.53bil) on April 25, promising a more lenient touch to policing content on the social media platform where he – the world’s richest person – promotes his interests, attacks critics and opines on a wide range of issues to more than 83 million followers.

New texts shed light on Elon Musk’s 2018 spat with Saudi fund

Elon Musk’s short-lived effort to take Tesla Inc private after his infamous “funding secured” tweet in August 2018 has loomed over the billionaire’s reputation – and his quest to buy Twitter Inc.

Twitter limits Musk’s potential stake to 15% with ‘poison pill’

Responding to Musk's bid, Twitter's board adopted a limited duration shareholder rights plan called a "poison pill" that makes it difficult for Musk to increase his stake beyond 15%.

Elon Musk’s move to buy Twitter faces roadblocks

Even for the richest person on the planet, buying Twitter was always going to be a challenge – a highly complex financial transaction now made even trickier by a defensive “poison pill” move from the platform’s board.

Guns and power: Positioning for new era in European stocks

LONDON: A month of the war in Ukraine briefly erased a year’s worth of gains for European equities but the continent’s bourses have quickly recovered as investors have poured money into sectors such as energy and defence which are poised to benefit from one of the deepest policy shifts in the region in decades.

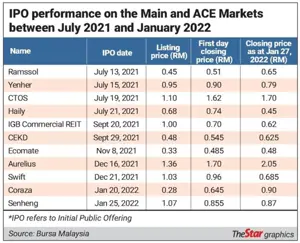

Tough times for IPOs

GONE are the days when investors on Bursa Malaysia are spoilt for choice when it comes to large listings.