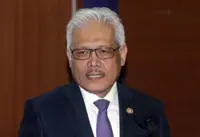

PETALING JAYA: The Employees Provident Fund (EPF) is working towards removing all eligibility conditions for the i-Sinar withdrawal facility, says Finance Minister Tengku Datuk Seri Zafrul Tengku Aziz.

He said the decision was based on the advice of Prime Minister Tan Sri Muhyiddin Yassin for EPF to improve the initiative after taking into consideration public feedback.