Ranhill Utilities Bhd has been seeing some volatility of late accompanied by a spike in trading volume.

has been seeing some volatility of late accompanied by a spike in trading volume.

While the gains remains capped for now, the increased investor interest bodes well for the share, which is seeking to surpass a recent trading high of RM1.47 and return to January's trading peak of RM1.58.

Looking at the technical indices, there is some consolidation pressure as the slow-stochastic has turned lower at 37 points.

The 14-day relative strength index (RSI) remains strong at 53 points, while the daily moving average convergence/divergence (MACD) histogram continues to chart negative bars

Support for the share is pegged to RM1.30 and RM1.13.

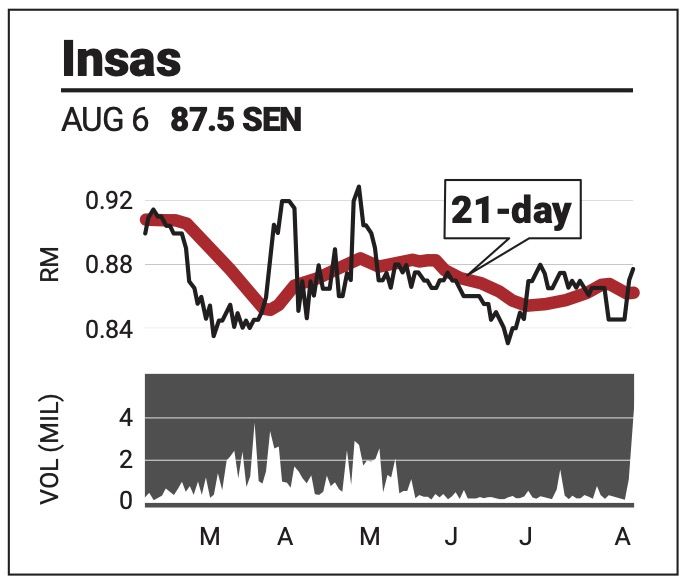

Insas Bhd climbed over the last two days on a surge in buying interest that saw turnover rise to its highest since January.

climbed over the last two days on a surge in buying interest that saw turnover rise to its highest since January.

However, the share failed to cross the 200-day simple moving average (SMA), which continues to cap its progress.

The positive momentum on the slow-stochastic remains in its budding stage as it rises to 29 points. The RSI, however, has also risen to 60 points, indicating bullish momentum.

The MACD histogram has also given a bullish signal, with a return to the positive end of the chart.

In breaching the 200-day SMA, the share is expected to rise past the 95 sen resistance to challenge RM1.19. Support is found at 83 sen and 75 sen.

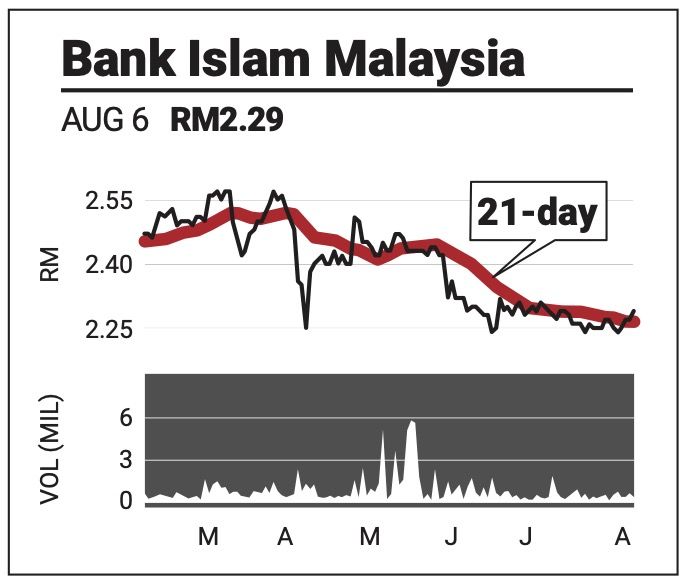

Bank Islam Malaysia Bhd rose towards the falling 50-day SMA line yesterday amid rising momentum.

rose towards the falling 50-day SMA line yesterday amid rising momentum.

The share is looking for a way past its ongoing consolidation, which would involve a positive breach of the 50-and 100-day SMA lines - following which it could attempt a recovery towards RM2.45, and a December 2024 level of of RM2.63.

The technical indicators are looking promising with the slow-stochastic at 69 points and the RSI recovering to 54 points. The MACD is also charting higher positive bars to indicate an optimistic outlook.

Support for the share lies at RM2.24 and RM2

The comments above do not represent a recommendation to buy or sell.