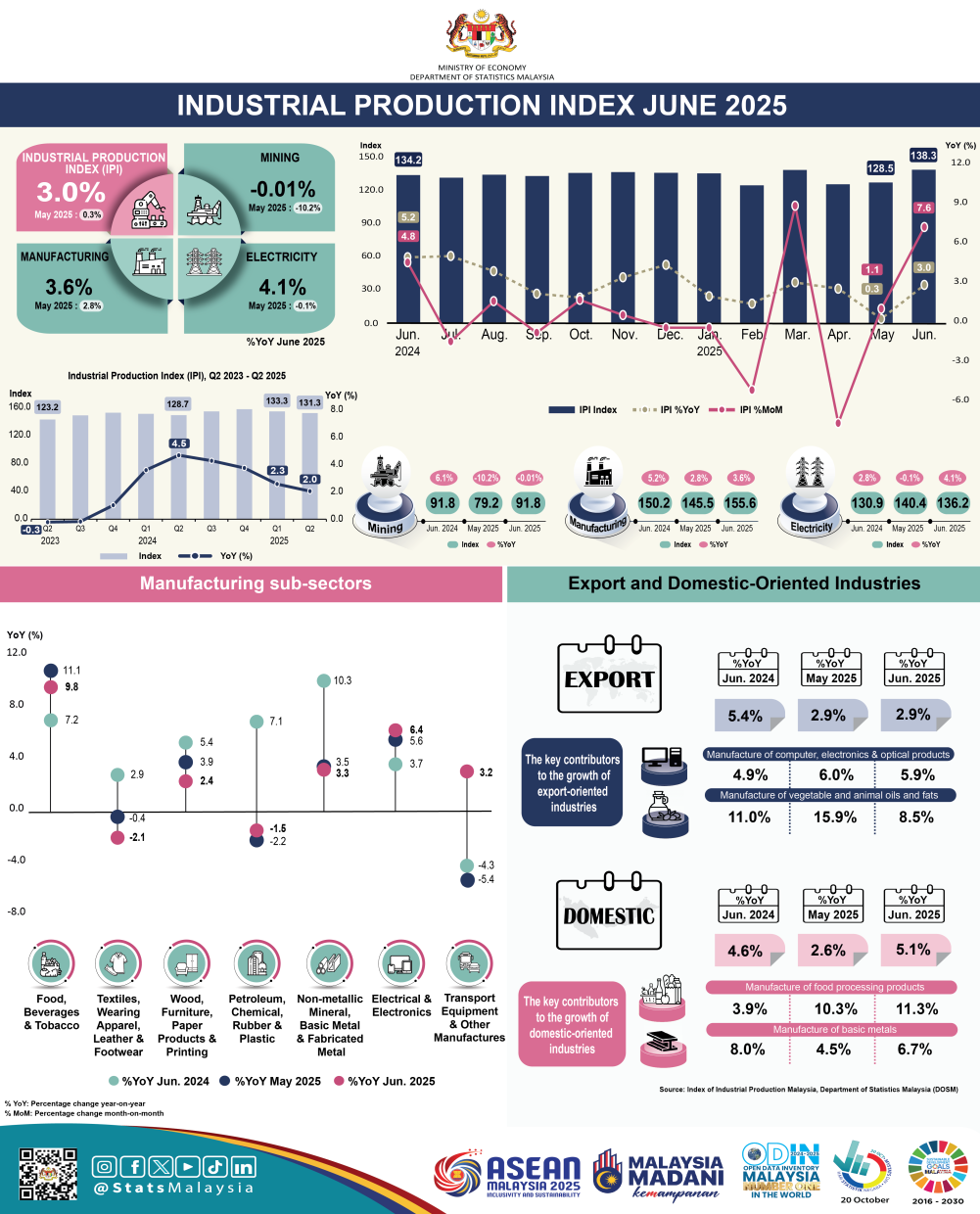

KUALA LUMPUR: Malaysia's Industrial Production Index (IPI) increased by a significant 3.0 per cent in June 2025 from 0.3 per cent in May 2025 driven by growth momentum in the manufacturing and electricity sectors, according to the Statistics Department Malaysia (DOSM).

Chief statistician Datuk Seri Dr Mohd Uzir Mahidin said the increase was due to encouraging output growth in manufacturing, which grew by 3.6 per cent (May 2025: 2.8 per cent) contributed mainly by domestic-oriented industries, and the electricity sector which increased to 4.1 per cent (May 2025:- 0.1 per cent).

Mining production, nevertheless, remained in negative territory settling at a -0.01 per cent against a -10.2 per cent in May 2025. It recovered exponentially in June 2025 due to a jump in natural gas production of 2.3 per cent.

Mohd Uzir said domestic-oriented industries grew by 5.1 per cent in June 2025 versus a 2.6 per cent increase in May 2025.

This rapid growth was supported by a double-digit 11.3 per cent rise in manufactured food products, followed by an increase in manufactured basic metal production (6.7 per cent), and motor vehicles, trailers, and semi-trailers, which rose by 3.4 per cent in June 2025.

Export-oriented industries recorded a 2.9 per cent growth, following the same rise recorded in the previous month. The steady growth was due to a 5.9 per cent decline in the manufacture of computers, electronic and optical products.

DOSM outlined IPI growth of in the following order, Taiwan at 18.6 per cent, Vietnam 10.8 per cent, Singapore at eight per cent, China at 6.8 per cent, Japan four per cent and South Korea at 1.6 per cent.

The United States IPI grew 0.7 per cent and Thailand at 0.6 per cent in June 2025. - Bernama