Ta Ann Holdings Bhd sustained its rally for a third day yesterday to breach the 100-day simple moving average (SMA).

sustained its rally for a third day yesterday to breach the 100-day simple moving average (SMA).

The share is en route to a resistance of RM4.10, which would mark its highest price level in nearly three months. Furthermore, the share could arrive at a hurdle of RM4.30.

There have been strong positive developments in the technical indices, including the slow-stochastic, which surged to an overbought level of 84 points.

The 14-day relative strength index (RSI) has also climbed to 56 points while the daily moving average convergence/divergence (MACD) histogram is turning more bullish.

Support levels are seen at RM3.70 and RM3.40.

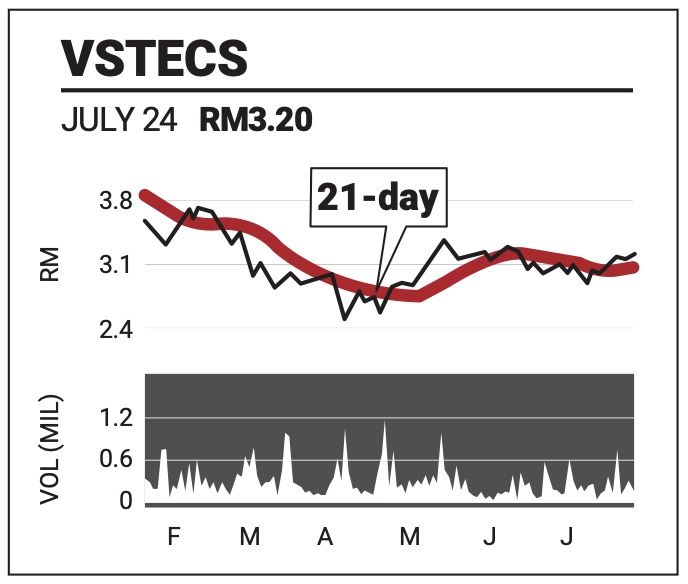

Vstecs Bhd is experiencing consolidation pressure under the 200-day SMA line.

is experiencing consolidation pressure under the 200-day SMA line.

However, the slow-stochastic, which remains strong at 55 points, is turning higher to suggest the end of the neutralisation period and the resumption of upward momentum.

The RSI is robust at 60 points while the MACD is also charting growing bullishness.

Upon resumption of the rally, the share is expected to challenge the recent high at RM3.36, before moving higher to RM3.76.

Support for the share is pegged to RM2.90 and RM2.47.

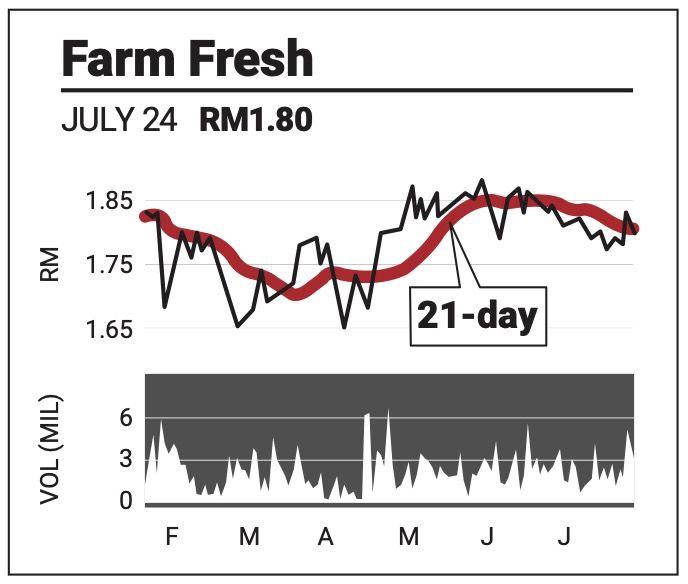

Farm Fresh Bhd made a strong rally towards the 50-day SMA line earlier in the week but remains capped by the hurdle on lack of follow-through buying.

made a strong rally towards the 50-day SMA line earlier in the week but remains capped by the hurdle on lack of follow-through buying.

Going by the technical indices, however, the upside momentum remains strong, suggesting a possible breach of the hurdle. The slow-stochastic has risen to a high 70 points while the RSI has dipped to 47 points.

The MACD is also posting higher positive bars to reflect continued bullishness.

The share has a historical trading high of RM1.94, which represents the upper price target. Support lies at RM1.76 and RM1.65.

The comments above do not represent a recommendation to buy or sell.