Padini Holdings Bhd made a strong rebound yesterday as it attempts to resume an uptrend

made a strong rebound yesterday as it attempts to resume an uptrend

The share, however, needs to extend its recovery past the overhead 200-day simple moving average (SMA) en route to taking out a recent high at RM2.18.

Both the slow-stochastic and 14-day relative strength index (RSI) have crossed the 50-day mid-line to signal bullish momentum, while the daily moving average convergence/divergence (MACD) histogram is pulling up from negative territory.

Support is pegged to RM1.91 and RM1.60.

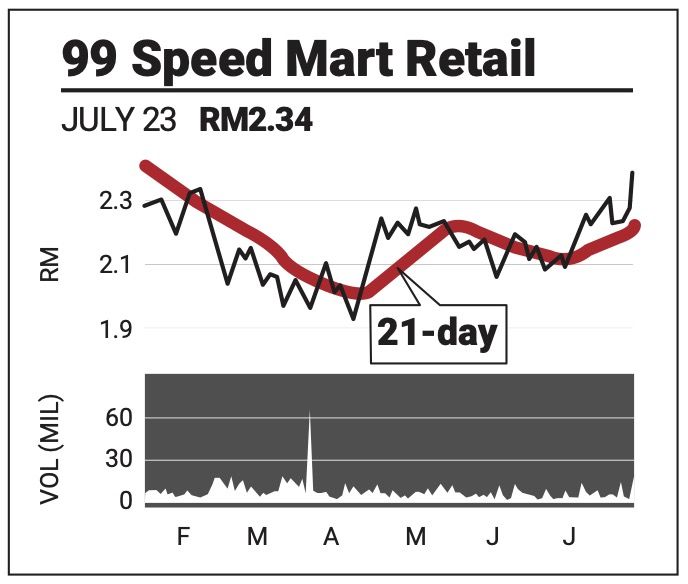

99 Speed Mart Retail Holdings Bhd took off on strong buying interest yesterday, breaking through a recent price high at RM2.30 to signal the resumption of its uptrend.

took off on strong buying interest yesterday, breaking through a recent price high at RM2.30 to signal the resumption of its uptrend.

The slow-stochastic was shown rising rapidly to 53 points, while the RSI paced higher to 66 points.

The MACD histogram has also charted a higher positive bar to suggest the resumption of bullish momentum.

Given the positive indications, there is an opportunity for the share to retrace fully its correction between December 2024 to April 2025, and returning to a historical high of RM2.63.

Meanwhile, the key SMA lines are rising in support of the share. Support levels can been at RM2.20 and RM2.

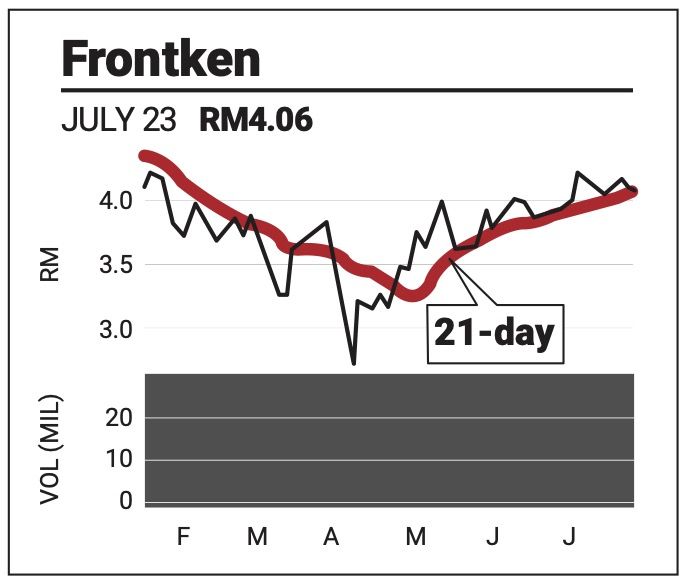

Frontken Corp Bhd 's rally is showing signs of stalling as the price continues in a sideways direction.

's rally is showing signs of stalling as the price continues in a sideways direction.

The slow stochastic has subsided to a weak level of 43 points while the RSI has retreated to 52.

The MACD histogram shows declining momentum.

The uptrend is expected to resume following the end of the consolidation phase with resistance at RM4.26 and RM4.59.

Support lies at RM3.90 and RM3.51.

The comments above do not represent a recommendation to buy or sell.