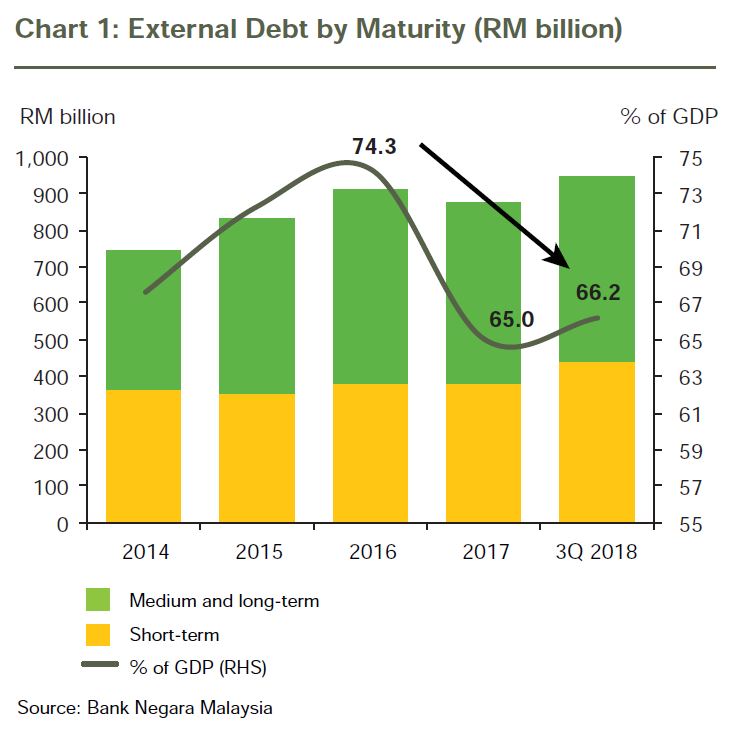

KUALA LUMPUR: Malaysia’s total external debt declined to 66.2% of gross domestic product (GDP) as at end-Q3, 2018 from a peak of 74.3% of GDP as at end-2016.

Bank Negara said on Friday that the bulk of the external debt was by corporations and banks.

“Foreign currency-denominated external debt stood at 46.0% of GDP as at end-Q3 2018, compared to the highest level of 60.0% of GDP during the 1997 Asian Financial Crisis,” it said in a report on the country's external debt.

The report said the government’s foreign-currency denominated external debt was very low (1.2% of GDP).