Profits at companies in the small-cap measure are estimated to increase 21% in the next 12 months, compared with a 3.5% gain for the local index.

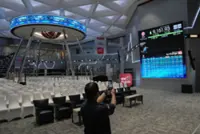

KUALA LUMPUR: Malaysia’s top-performing fund manager is adding to holdings of the nation’s small-cap stocks, betting that a bull-market rally will continue as earnings improve and valuations trail larger peers.

Kenanga Investors Bhd favours exporters and builders as the US economy recovers and Malaysia boosts spending on infrastructure, chief investment officer Lee Sook Yee said in an interview. The FTSE Bursa Malaysia Small Cap Index is valued at 10.2 times estimated earnings, a 39% discount versus the FTSE Bursa Malaysia KLCI Index of the biggest stocks.

Already a subscriber? Log in

Save 30% OFF The Star Digital Access

Cancel anytime. Ad-free. Unlimited access with perks.