General Motors, one of America’s top carmakers, leads US companies in its exposure to China, perched in a delicate position as bilateral trade tensions persist amid US President Donald Trump’s steep 55 per cent tariffs on imports from the country, according to a research report published this week.

Other high-profile firms, including Elon Musk’s electric vehicle company Tesla, rival carmaker Ford, engine manufacturer Cummins, aerospace and tech firm Honeywell, beverage giant Coca-Cola, and chipmaker Qualcomm also rank in the top 10, illustrating corporate America’s dependence on the country.

Influential companies Amazon, Apple, Meta and Nvidia did not make it to the top 10, but remain among the largest tech firms at risk due to disruptions in the Chinese market and their global supply chains.

That is according to the latest annual index from market research firm Strategy Risks, which assessed the top 250 publicly listed US companies to identify those most vulnerable to US-China trade tensions in 2025.

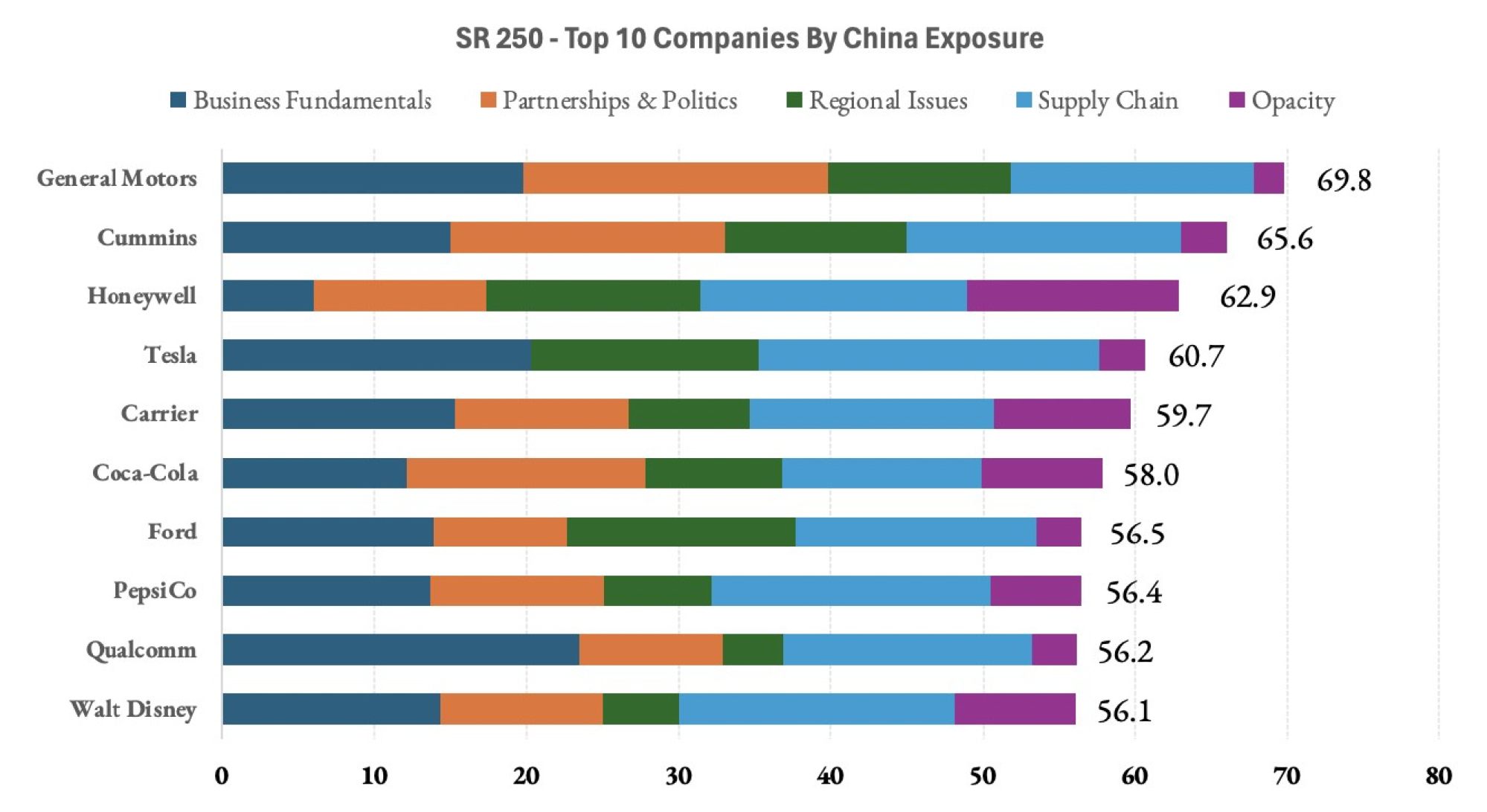

The report analyses a range of public information – including company filings, media reports, and government data – to assign each firm an exposure score from 0 to 100.

The evaluation considered factors such as supply-chain dynamics, ties to the Chinese government and Communist Party officials, industry-specific regulations in China and even biases in the data sets related to a firm’s transparency on China-related information.

With a score of 69.8, GM topped the list, followed closely by Cummins and Honeywell at 65.6 and 62.9 respectively. Tesla scored 60.7 while Coca-Cola tallied 58, closely trailed by Ford at 56.5 and Qualcomm at 56.2.

The report attributes GM’s top ranking to its “relatively high number of joint ventures with Chinese state-owned companies”.

According to the carmaker’s website, it has 10 joint ventures in China, including a 50-50 joint venture called SAIC-GM with SAIC Motor, a state-owned Chinese company.

In December, GM said it expected to lose more than US$5 billion as it reorganised its struggling business in China, where car sales have dropped sharply.

According to Juozapas Bagdonas of Strategy Risks, General Motors has not only been significantly affected by tariffs, but recent restructuring of some of its joint ventures in China has also made the company more “politically exposed”.

“They hold less power over those joint ventures,” he said, “and potentially the government could impose their will on intellectual property, or any other things that might be important for some American company like GM.”

Chinese officials have recently sought to allay concerns that foreign companies operating on the mainland might harbour amid ever-escalating trade tensions.

Speaking at the US-China Business Council in Washington last week, Xie Feng, Beijing’s ambassador to Washington, said many American firms were increasingly worried about “losing the Chinese market” and that their R&D efforts would “slow down”.

“Your concerns should be heeded,” Xie added.

Tesla and Ford scored high this year in the category assessing exposure to politically sensitive areas and human-rights concerns “due to their extensive presence in Xinjiang and Tibet, as well as their public overtures to the Chinese government on sensitive issues”, the report stated.

Colgate-Palmolive, a consumer products company, was also listed as among the most vulnerable to disruptions due to its heavy reliance on Chinese exports of plastic and electric toothbrushes, “with hundreds of containers shipped from Chinese ports to the US in 2024”.

Apple, which topped last year’s list at No 2, slipped to No 27 this year, but it still rated among the largest tech companies most exposed to China, along with Amazon, Microsoft, Meta and Nvidia.

The California-based tech giant still earns about 17 per cent of its revenue from China, and a substantial risk lies in its hundreds of manufacturing facilities across the country that build iPhones and MacBooks.

The report warned that any serious supply-chain disruption in China “could prove catastrophic” for Apple, even as it shifts more of its production to India.

Electronics like smartphones and laptops are currently exempt from Trump’s 10 per cent reciprocal tariffs on China.

Bagdonas believed tariffs played a major role in companies looking to reduce their exposure to China.

More than Trump’s on-and-off reciprocal duties, the Section 301 tariffs imposed in response to alleged unfair Chinese trade practices, including forced tech transfers and intellectual property violations, were longer lasting and of greater concern, he said.

These tariffs, introduced at the outset of the US-China trade war in 2018, were repeatedly renewed under former US president Joe Biden.

“For example, Tesla is subject to pretty high tariffs that have stayed in place since Biden took office and continue to be extended,” Bagdonas said.

“But then again, companies like Apple have largely been exempt from tariffs on smartphones, MacBooks and other electronics.”

In the report’s overall rankings, Amazon came in at 20th, driven by its heavy reliance on Chinese-made products, which dominate its shipments to Western markets.

In 2023, US shoppers spent about US$200 billion on Chinese goods via Amazon, bringing the company an estimated US$70 billion in net profit.

Microsoft placed 29th, with the report citing thousands of electronics shipped from China in 2024. Key AI components like doped silicon wafers face a 50 per cent tariff, potentially slowing its AI expansion.

Nvidia came in at 85th, hindered by American export bans on its top chips to China. The company is now focusing on autonomous driving, supplying Orin chips to Chinese electric vehicle maker BYD, the world’s largest in the sector.

Meta ranked 94th, with its China revenue rising 34 per cent in 2024 to account for 11 per cent of total earnings.

It also earns about US$7 billion a year from Chinese retailers like Temu and Shein through ad sales and relies on Chinese electronics for its VR and AI hardware, the report found.