PETALING JAYA: Basic necessities will continue to be exempted from the sales tax, while non-essential items will be imposed a tax rate of 5% to 10%, says the Finance Ministry.

This follows the ministry’s announcement on the revised and expanded Sales and Service Tax (SST) rate, as announced in Budget 2025, which comes into effect on July 1.

The ministry said the move is to strengthen the country’s fiscal position by increasing revenue and broadening the tax base.

It said this would improve the quality of the social safety net without over-burdening the people.

“To ensure that the majority of people are not affected by the Sales and Service Tax revision, the government is taking a targeted approach to ensure that basic goods and services are not taxed,” it said in a statement yesterday.

The ministry said the additional revenue from the SST enhancements will be used to improve public services and infrastructure, and to increase cash assistance to citizens.

The ministry said the SST review was done following consultations with stakeholders, including industry associations and tax agents.

The legal aspects were taken into account after obtaining the feedback from these groups to minimise industry impact.

Sales tax

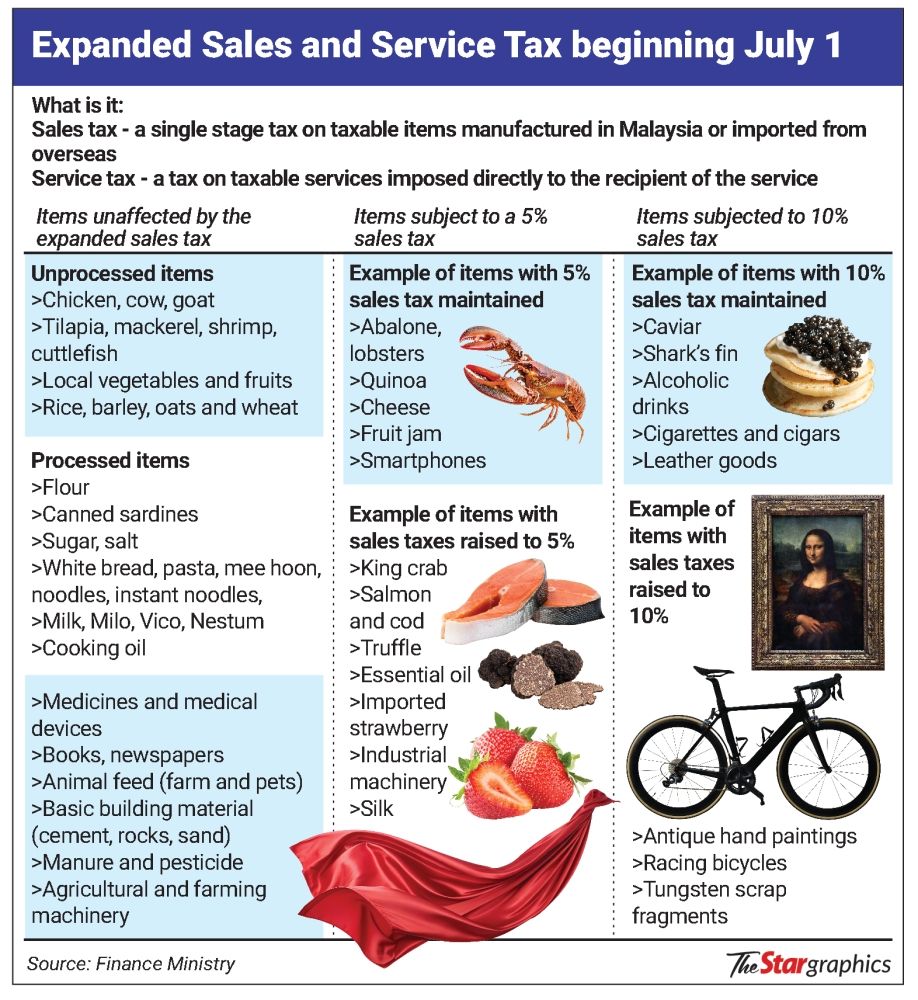

Items that remain in the 0% sales tax bracket include unprocessed items such as chicken, beef or lamb, seafood like tilapia, tongkol, prawns and squid, vegetables and local fruits as well as rice, barley, oat and wheat.

Processed items with zero-rated sales tax are flour, canned sardine, sugar and salt, white bread, pasta, mee hoon, noodles and instant noodles, milk, malt drinks such as Milo, Vico and Nestum as well as cooking oil.

A zero sales tax rate is also maintained for medicine and medical devices, books, journals and newspapers, livestock feed and pet food, basic construction materials such as cement, stones and sand, agricultural products like fertilisers, pesticides as well as agricultural and farming machinery.

Items that will remain in the 5% sales tax bracket are abalone and lobster, quinoa, cheese, fruit jams and smartphones.

Those that will see the revision of sales tax to 5% beginning July 1 are king crab, salmon and cod fish, truffle, imported strawberries, essential oils, silk fabrics and industrial machinery.

Items that will remain in the 10% sales tax bracket are caviar, sharks’ fin, alcoholic beverages, cigarettes, cigars and leather products.

Goods that will see their sales tax increase to 10% are tungsten scrap waste, racing bicycles and antique hand paintings.

Service tax

The existing service tax scope will be expanded to cover six types of services: rental or leasing, construction work, financial, private healthcare, education and beauty.

Rental or leasing services

An 8% service tax will be imposed on rental or leasing services, with no tax imposed on residential housing, reading material, monetary leasing and tangible assets outside Malaysia.

Exemptions are given to business-to-business (B2B) transactions and relief groups to avoid double taxation.

MSMEs with less than RM500,000 annual turnover need not pay service tax, while non-reviewable contracts are granted a 12-month exemption from the effective date.

Construction work services

A 6% service tax will be levied on construction work services related to infrastructure, commercial and industrial buildings.

Contractors must register if their taxable service value reaches RM1.5mil within 12 months, easing compliance for small and medium contractors.

However, construction work services for residential buildings and public facilities related to residential houses are exempted from this tax.

To prevent double taxation, B2B transactions will benefit from exemption facilities. Additionally, non-reviewable contracts are granted a 12-month exemption from the effective date.

Financial services

An 8% service tax applies to financial services based on fees or commissions. Providers must register if their total fees or commissions reach RM500,000 within 12 months.

However, several services are exempt from this tax, including syariah-compliant financing profits, gains from foreign exchange and capital markets, brokerage and underwriting on life and medical insurance/takaful for individuals, fees on credit and charge cards, basic banking services (like savings and current accounts), exported financial services as well as penalty charges.

B2B exemptions are also given to avoid double taxation. Certain fees in syariah-compliant transactions will receive exemptions, while exemptions for Bursa Malaysia and in Labuan are maintained.

Healthcare services

A 6% service tax is imposed on healthcare services provided to non-Malaysians. This includes services offered by facilities under the Private Healthcare Facilities and Services Act 1998, private traditional and complementary medicine practices and private allied health services.

Providers must register if the taxable value of their services reaches RM1.5mil within 12 months.

Healthcare services provided by the government and private healthcare services under the Universities and University Colleges Act 1971 and the Universiti Teknologi Mara Act 1976 are not subject to this tax.

Malaysians are exempt from paying service tax on private healthcare services, private traditional and complementary medicine as well as private allied health services.

Education services

A 6% service tax applies to private pre-school, primary and secondary schools, including higher learning institutions and language centres.

There is no minimum turnover threshold for registration but schools charging more than RM60,000 in annual tuition fees per student must register.

Public education services are not taxable. Malaysian citizens who hold a disabled persons (OKU) card are exempt from paying the service tax.

For higher learning institutions and language centres, there is no minimum turnover threshold for registration, but those providing education services to non-citizens must register. Malaysians are also exempt from this tax.

Beauty services

An 8% service tax applies to beauty services. Providers must register if their taxable services reach RM500,000 within 12 months.

The beauty services include facial, manicure and pedicure, hairstyling, tattoo, make-up services and body slimming, including herbal, milk and flower baths.