Financial freedom has become an increasingly popular pursuit among wage earners around the world.

In fact, many are aiming to achieve economic independence before they turn 60.

With rising living costs and a shifting economic landscape, the concept of early financial freedom, often through smart investments, budgeting and side businesses are gaining momentum.

A 2024 study published in Research Gate (an online platform for scientific publications) on factors associated with financial independence of young adults found that respondents consider financial independence necessary when entering adulthood.

“Economic self-efficacy is an important factor for young adults seeking financial independence,” it says.

As more individuals embrace the idea of securing their financial future, some emphasise the importance of financial literacy, discipline and long-term planning in achieving these aspirations.

This growing trend reflects a shift towards a more proactive approach to personal finance among employees everywhere.

Breaking the cycle

Marty Frances, 35, is on the right track of achieving financial freedom early.

As a New Zealand native who is married to a Malaysian, Frances’s journey towards this financial milestone began in his mid 20s. His family lived paycheque to paycheque while he was growing up, and they frequently waited impatiently for their wages to clear.

This anxiety left a lasting impression on Frances, motivating him to pursue financial independence as he grew older.

“I didn’t want to live week to week,” he says, “So I made the decision to break the cycle.”

Frances’s path to achieving early financial freedom first started as an interest in the topic when he took a year off from work to travel around Europe.

Originally intended as a brief getaway, Frances’s visit to Europe turned into a three-year journey during which he lived off his savings.

“Watching my savings deplete every month pushed me to learn how to make my money work for me and not the other way around,” he says.

His decision to enrol in a six-week course on futures trading during his stay in Britain further expanded his financial knowledge, even offering him a role with the course’s instructors.

This epiphany led him to explore the concept of Financial Independence, Retire Early (Fire) – a lifestyle that focuses on saving and investing aggressively to retire early.

Real estate also played a significant role in Frances’s success as the majority of the assets he owns today are properties.

“Most of my assets are in property, and I believe it’s important to understand how different types of investments compare,” he says. “This strategy has been a major way I have worked towards financial freedom.”

Turning passion into profit

While Frances’s journey focused on financial discipline and calculated investments, Christopher Leong’s path to financial independence started with a passion for baking.

At 35, the father of one transformed his baking skills into a successful business called Chris Kitchen KL that provides him with both income and independence.

His drive for financial freedom emerged during the Covid-19 pandemic when Leong was working as a barista. Given the unpredictability of the food sector, he saw a chance to improve his long-term income by converting his hobby into a full-time business.

“I realised that focusing on my passion was the path forward,” he says. Starting small, Leong began selling his baked goods to local cafes, building his reputation through quality and consistency.

The business quickly grew, and with it, his financial understanding. “I educated myself through trial and error,” he explains. “I used spreadsheets to track my income and expenses and watched YouTube videos on managing small businesses.”

Although Leong takes a more cautious approach when it comes to investing, he still sees the importance of making smart financial choices.

Like Frances, Leong also wishes to invest in real estate sometime in the future, but for now, he plans to focus on building his baking business, keeping his lifestyle simple and disciplined.

“I choose to prioritise efficiency instead of looking at unnecessary luxuries,” he adds.

Financial literacy necessary

According to financial literacy specialist Nalissa Suria and business consultant Thirumurugan Shanmugam, young people can attain financial freedom early by focusing on the importance of financial literacy, discipline and setting clear goals.

Thirumurugan, 58, believes that financial freedom is more than accumulating wealth; it is about living debt-free, having the flexibility to choose one’s desired lifestyle and having a steady income that makes work optional.

“For most people, achieving financial freedom by the age of 45 to 50 is within reach,” he explains, “but they must have a solid foundation in financial literacy early on in their life.”

After becoming financially independent himself, he suggests that whenever one starts working, they should make a budget and set aside at least 15% to 20% of their monthly income for savings.

When savings accumulate, he then advises considering investments in stock or real estate as those options can help boost long-term wealth.

“It is important for young people to come up with clear financial goals like this... consistently saving is the key to financial success,” he says.

Attached to Arus Academy, a social enterprise for sustainable education, Nalissa, 29, says financial freedom means having enough income to sustain one’s lifestyle.

“It means having enough money without having to rely on a source of income, like a 9-5 job,” she says.

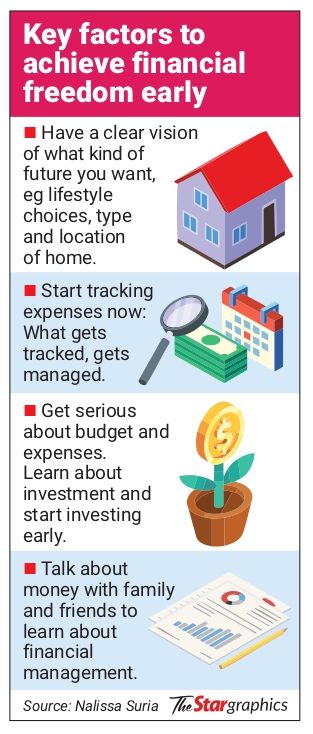

She believes the first step to early financial freedom is understanding precisely what you want to achieve and how much you need to sustain your lifestyle.

“I think the general assumption is financial freedom is an unattainable dream but I also know many Malaysians in their 30s who have achieved financial freedom on their own terms.”

Like Thirumurugan, Nalissa also stresses the importance of financial literacy as that helps individuals set their goals, budget and track expenses effectively.

“Financial literacy educates people on the skills required to achieve financial freedom such as goal setting, budgeting and tracking expenses, savings, investing and financial protection,” she explains.

She warns that failing to track actual spending versus the planned budget can lead to derailment, so people should treat budgeting and expense tracking as complementary processes.

Nalissa recommends having sinking funds and tracking expenses. She has personally found these strategies to be the most successful in helping manage her money.

“Sinking funds help plan and budget for an expense that we know is going to happen, such as car maintenance or a vacation,” she shares.

“Tracking expenses, on the other hand, allows you to know exactly where your money goes and that helps for better budgeting,” she concludes.