KUALA LUMPUR: Sukuk issuance in the 10 largest markets fell last year following record issuance in 2017 but the issuance is more likely to stabilise or slightly recover in 2019 than fall further, Fitch Ratings says.

“We do not believe this (decline in 2018) reflects long-term trends, but it shows how issuance volumes can be influenced by the activity of individual borrowers, notably oil-exporting sovereigns,” it said on Wednesday.

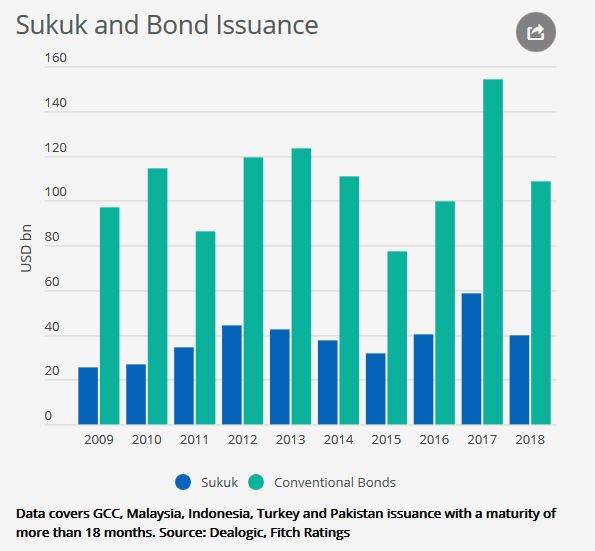

The ratings agency said sukuk issuance with a maturity of more than 18 months from the Gulf Cooperation Council (GCC) region, Malaysia, Indonesia, Turkey and Pakistan totalled US$39.8bil in 2018 – down nearly one-third from the previous year, but in line with the 2012-2016 average.

Last year's 30% decline in conventional bond issuance suggests that lower sukuk issuance was principally a function of higher oil prices in 9M18, which reduced immediate borrowing needs among some sovereigns and improved liquidity in their banking systems.

US monetary tightening has also raised borrowing costs. Sukuk's share of total issuance was broadly unchanged at 27%.

“Debt capital markets in the GCC are relatively immature, and individual sovereign funding decisions can profoundly affect total supply,” said Fitch.