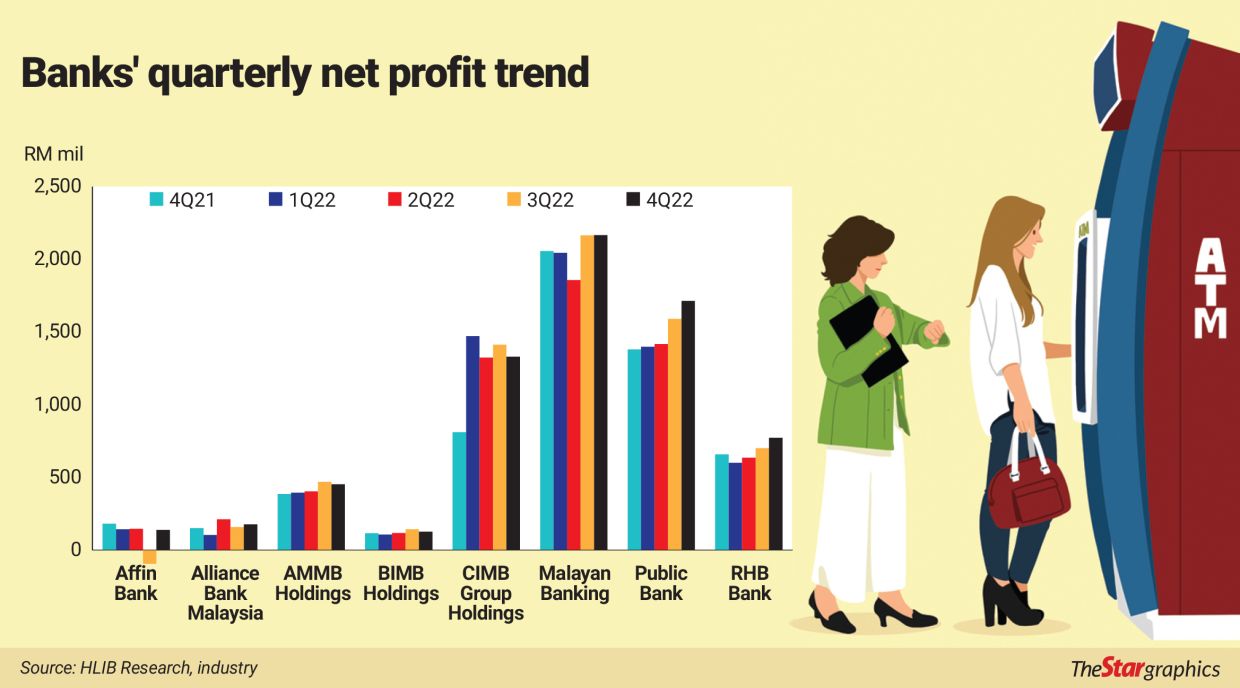

KUALA LUMPUR: After emerging from a strong fourth quarter last year pursuant to the recent conclusion of the earnings reporting season, the Malaysian banking sector appears to be poised to continue its strong run in the near term.

Already a subscriber? Log in

The Star Festive Promo: Get 35% OFF Digital Access

Cancel anytime. Ad-free. Unlimited access with perks.

Follow us on our official WhatsApp channel for breaking news alerts and key updates!

Thank you for your report!