GEORGE TOWN: A 1ha First Grade land in Bandar Alma that was previously taxed RM49.42 a year under an oil palm plantation rate is now liable for RM32,500 because it was found to be used for industrial purposes.

Another piece of First Grade land measuring 1,546sq m in Balik Pulau town used to pay a quit rent or land tax bill of RM12 a year, but must now pay RM1,083 as the land is now used for residential purposes.

Chief Minister Chow Kon Yeow provided these real-life examples to explain why many landowners are seeing their land tax rise by “a thousandfold” this year.

“The fact is, those new land tax rates are what all landowners pay for industrial, residential, commercial and agricultural land.

“The complaints come specifically from First Grade landowners,” he said in a statement on Sunday.

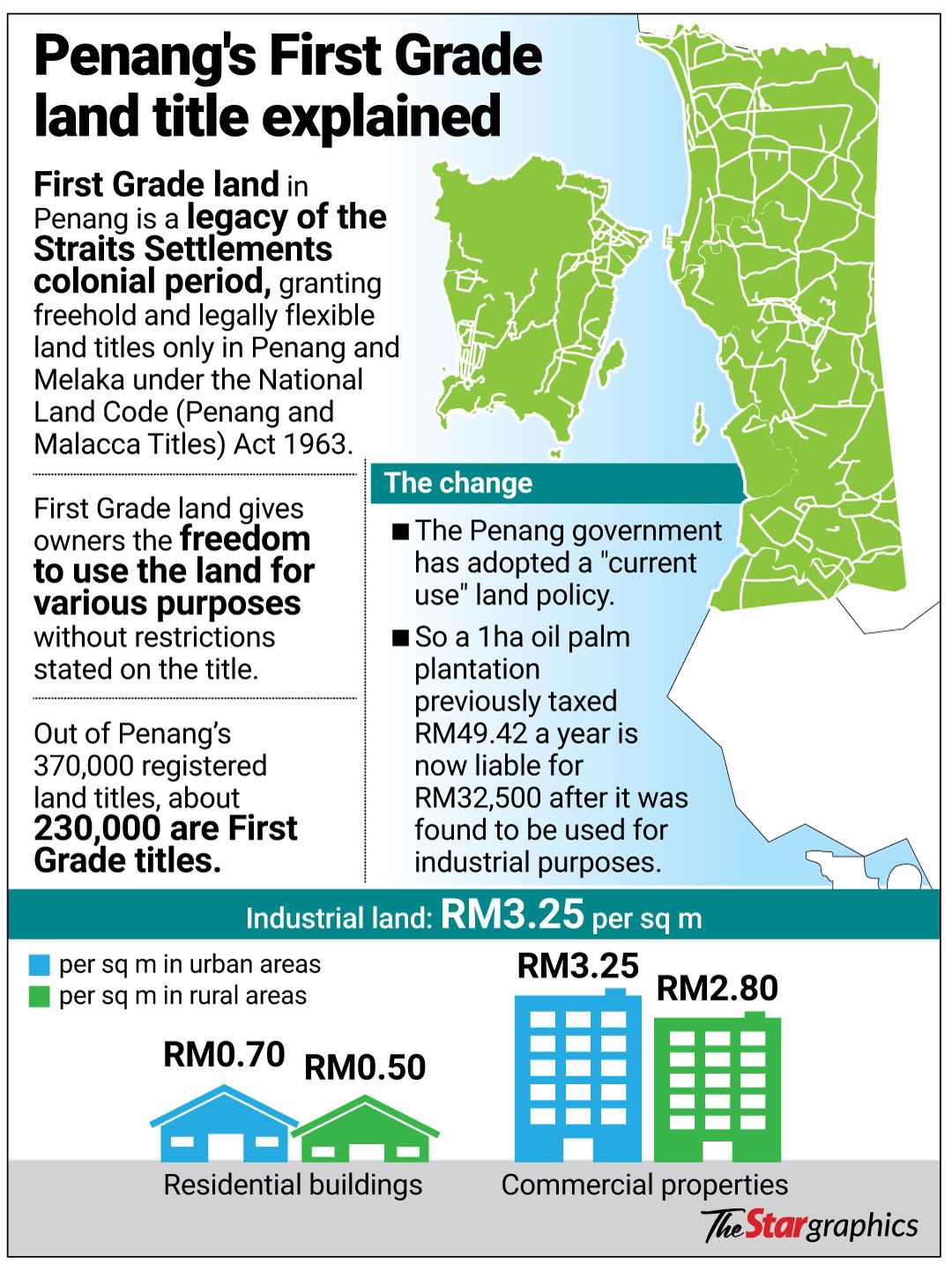

First Grade land in Penang is a premier, freehold and legally flexible land title restricted to Penang and Melaka under the National Land Code (Penang and Malacca Titles) Act 1963.

The advantage of First Grade land, Chow explained, was that owners were free to use the land for various purposes without restrictions stated on the title.

The absence of a clear category or condition, however, had posed difficulties for land administrators in determining the appropriate tax rate.

Chow said many such titles had been taxed at nominal agricultural rates since 1994, including padi at RM9.88 per hectare, oil palm at RM49.42 per hectare and other agriculture at RM12.35 per hectare, even when residential or commercial buildings had been built on the land.

He said that of Penang’s 370,000 registered land titles, about 230,000 were First Grade titles.

The state, he explained, had adopted a “current use” policy in determining land tax rates.

Under the revision gazetted on Sept 11 last year, land tax for First Grade and Condition A, B and C titles is now calculated according to what is physically built and operating on the site.

He stressed that the state had not reviewed land tax rates for more than 30 years and the new approach aimed to standardise assessment based on actual use.

Owners affected by the revision may submit appeals at the Land Office.

District Land Offices may consider reductions of up to RM20,000, while appeals exceeding that amount would be referred to the Director of Lands and Mines and subsequently to the state executive council.

Among grounds that may qualify for up to a 50% rebate are land used for non-profit public purposes, owners or heirs facing hardship due to poverty or disability, significant loss of income due to disasters or other factors, land without access roads, bankrupt or wound-up individuals or companies.

Other factors that are considered are buildings spanning more than one lot, abandoned housing schemes, First Grade titles affected by the latest revision, durian agricultural land and land undergoing reclassification from rural to urban status.