PETALING JAYA: Continuous feedback and close cooperation will be given to the government to implement the Reset initiatives announced by the Joint Ministerial Committee on Private Healthcare Costs (JMCPHC).

Association of Private Hospitals Malaysia (APHM) said in a statement yesterday that as a JMCPHC consultative committee member, it welcomed the outcome of the meeting.

“In particular, APHM supports proposed tax incentives aimed at encouraging private hospitals to expand their corporate social responsibility efforts through the establishment of welfare funds under Section 44(6) of the Income Tax Act.

“We believe this initiative will enable underprivileged patients to access treatment at private hospitals,” it said.

APHM said it would continue working closely with the government to provide feedback on this initiative, in line with the government’s aim of ensuring that clear and workable guidelines could be issued by the first quarter of 2026.

“APHM also welcomes the White Paper on MHIT’s design philosophy and patient-empowerment efforts, such as publishing prices for 26 common procedures and rolling out decision-support tools.

“These measures will meaningfully assist patients in making informed choices and navigating their healthcare options,” it added.

Overall, APHM views Reset as a positive step towards achieving sustainable, value-based healthcare for the nation.

Federation of Malaysian Consumers Associations (Fomca) secretary-general Dr Saravanan Thambirajah said premium hikes, opaque billing, and inconsistent medical charges had pushed healthcare beyond the reach of many Malaysians, particularly those in the middle-income group.

He added the Reset initiative would address the root cause of medical inflation by reforming how healthcare was financed, priced and delivered.

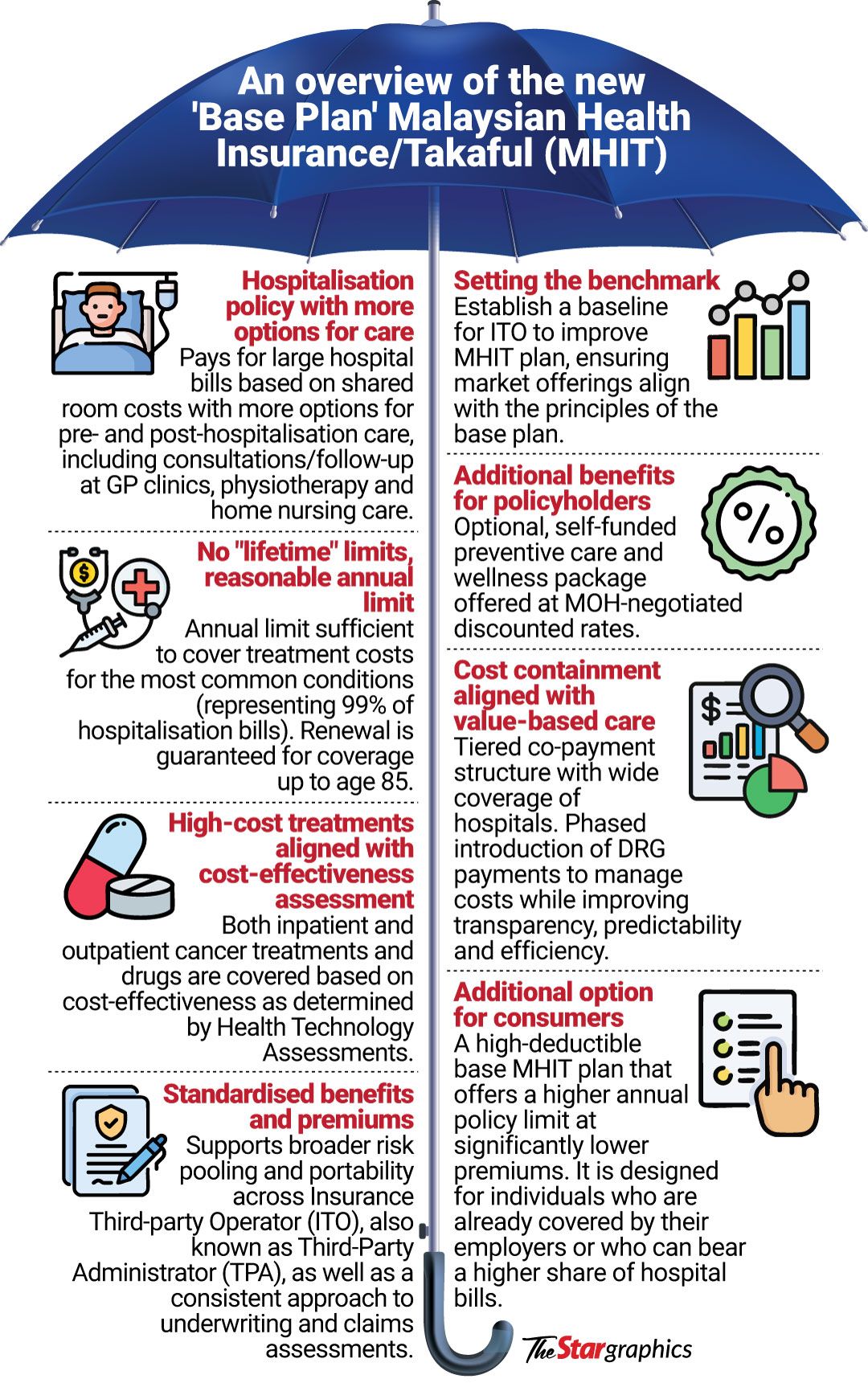

“For the public, one of the most immediate benefits is the introduction of a more affordable and standardised basic medical and health insurance or takaful product.

“Many consumers have been priced out of private medical insurance due to repeated premium increases that are not matched by income growth.

“By providing a more accessible entry-level product, Reset helps prevent consumers from being completely excluded from coverage while offering protection against major medical expenses,” he said.

Beyond affordability, Reset tackles medical inflation by improving transparency in healthcare pricing, he said.

“When fees, charges and treatment costs are clearer, it becomes harder for excessive or unjustified charges to persist.

“This transparency empowers consumers to make informed decisions and creates pressure within the private healthcare sector to moderate price increases,” he added.

Paediatrician and neonatologist Datuk Dr Musa Mohd Nordin said the baseline medical insurance framework provided a safety net for a wider population, especially vulnerable groups and those in the informal sector, preventing catastrophic out of pocket expenses that lead to medical poverty.

“More people will have choice and access to private care and lower waiting times for certain services,” he said.

Asked if it would address the issue of medical inflation, he said it was still a “double-edged sword”, as this depended largely on its design and regulatory framework.

“Medical and health insurance or takaful could negotiate fixed, standardised reimbursement rates with private providers for a defined basket of services.

“The plan can mandate use of generic drugs, approved medical devices, and evidence-based treatment protocols, reducing unnecessary or high-cost variations in care.

“By covering more people, it reduces the burden of uncompensated care in both public and private sectors, which is often a hidden cost driver,” he added.